F-1/A: Registration statement for securities of certain foreign private issuers

Published on September 30, 2024

Table of Contents

As filed with the U.S. Securities and Exchange Commission on September 27, 2024.

Registration No. 333-281663

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

BRAZIL POTASH CORP.

(Exact name of Registrant as specified in its charter)

| Ontario, Canada | 1400 | Not Applicable | ||

| (State or other jurisdiction of incorporation or organization) |

(Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

198 Davenport Road

Toronto, Ontario, Canada, M5R 1J2

Tel: +1 (416) 309-2963

(Address, including zip code, and telephone number, including area code, of Registrants principal executive offices)

CT Corporation System

28 Liberty Street

New York, New York 10005

Tel: +1 (302) 777-0200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

With copies to:

| Rebecca G. DiStefano William Wong Greenberg Traurig, P.A. 333 S.E. 2nd Avenue Suite 4400 Miami, Florida 33131 Tel: +1 (305) 579-0541 Fax: +1 (305) 579-0717 |

Michael Rennie Wildeboer Dellelce LLP 365 Bay Street, Suite 800 Toronto, Ontario, M5H 2V1 Canada Tel: +1 (416) 361-4781 Fax: +1 (416) 361-1790 |

Samir A. Gandhi Daniel A. OShea Sidley Austin LLP 787 Seventh Avenue New York, New York 10019 Tel: +1 (212) 839-5300 |

James Clare Christopher J. Doucet Bennett Jones LLP 3400 One First Canadian Place P.O. Box 130 Toronto, Ontario, M5X 1A4 Canada Tel: +1 (416) 863-1200 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. ☐

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act of 1933, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

| Emerging growth company | ☑ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the Registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act of 1933. ☐

| | The term new or revised financial accounting standard refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the U.S. Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the U.S. Securities and Exchange Commission is declared effective. This preliminary prospectus is not an offer to sell these securities, nor a solicitation of an offer to buy these securities, in any jurisdiction where the offer, solicitation, or sale is not permitted.

SUBJECT TO COMPLETION, DATED SEPTEMBER 27, 2024

PRELIMINARY PROSPECTUS

BRAZIL POTASH CORP.

Common Shares

This is the initial public offering of our common shares, no par value per share (which we refer to as our Common Shares). We are offering Common Shares. We currently expect the initial public offering price of our Common Shares to be between $ and $ per Common Share.

Prior to this offering, there has been no public market for our Common Shares. We have applied for the listing of our Common Shares on the New York Stock Exchange under the symbol GRO.

We are existing under the laws of the Province of Ontario, Canada. We are also an emerging growth company and a foreign private issuer, as defined under applicable U.S. federal securities laws, and are eligible for reduced public company reporting requirements. See Prospectus SummaryImplications of Being an Emerging Growth Company and a Foreign Private Issuer.

Investing in our Common Shares involves a high degree of risk. Before buying any Common Shares, you should carefully read the discussion of material risks of investing in our Common Shares under the section entitled Risk Factors beginning on page 27 of this prospectus.

Neither the U.S. Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| Per Common Share | Total | |||||||

| Initial public offering price |

$ | $ | ||||||

| Underwriting discounts and commissions(1) |

$ | $ | ||||||

| Proceeds to us (before expenses)(2) |

$ | $ | ||||||

| (1) | We have also agreed to issue to the underwriters warrants exercisable for the number of our Common Shares equal to 5% of the total number of Common Shares sold in this offering (which we refer to as the Underwriters Warrants). See Underwriting for additional information regarding underwriting discounts and commissions, expenses, and other compensation payable to the underwriters. |

| (2) | The proceeds to us (before expenses) presented in this table does not give effect to any exercise by the underwriters of (i) the option we have granted to the underwriters to purchase additional Common Shares from us as described below, or (ii) the Underwriters Warrants. |

We have granted the underwriters an option to purchase up to additional Common Shares from us at the public offering price, less the underwriting discounts and commissions, for a period of 30 days from the date of this prospectus to cover over-allotments, if any.

The underwriters expect to deliver the Common Shares to purchasers on or about , 2024.

| Cantor | Bradesco BBI |

| Freedom Capital Markets | Roth Capital Partners |

|||

| Clarksons Securities | ||||

The date of this prospectus is , 2024.

Table of Contents

| Page | ||||

| ii | ||||

| iv | ||||

| 1 | ||||

| 27 | ||||

| 55 | ||||

| 58 | ||||

| 59 | ||||

| 61 | ||||

| 64 | ||||

| MANAGEMENTS DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS |

66 | |||

| 85 | ||||

| 113 | ||||

| 129 | ||||

| 141 | ||||

| 158 | ||||

| 160 | ||||

| 163 | ||||

| 174 | ||||

| 177 | ||||

| 184 | ||||

| 197 | ||||

| 198 | ||||

| 199 | ||||

| 200 | ||||

| 200 | ||||

| F-1 | ||||

| A-1 | ||||

You should rely only on the information contained in this prospectus and any free writing prospectus prepared by us. Neither we nor the underwriters have authorized anyone to provide you with information that is different, and neither we nor the underwriters take any responsibility for, or provide any assurance as to the reliability of, any information, other than the information in this prospectus and any free writing prospectus prepared by us. We are offering to sell our Common Shares, and seeking offers to buy our Common Shares, only in jurisdictions where such offers and sales are permitted. This prospectus is not an offer to sell, or a solicitation of an offer to buy, our Common Shares in any jurisdictions where, or under any circumstances under which, the offer, sale, or solicitation is not permitted. The information in this prospectus and in any free writing prospectus prepared by us is accurate only as of the date on its respective cover, regardless of the time of delivery of this prospectus or any free writing prospectus or the time of any sale of our Common Shares. Our business, results of operations, financial condition, or prospects may have changed since those dates. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise, after the date of this prospectus.

Before you invest in our Common Shares, you should read the registration statement (including the exhibits thereto and the documents incorporated by reference therein) of which this prospectus forms a part.

i

Table of Contents

As used in this prospectus, unless the context otherwise requires or otherwise states, references to Brazil Potash, our Company, we, us, our, and similar references refer to Brazil Potash Corp., a corporation existing under the laws of the Province of Ontario, Canada, and its subsidiaries.

Financial Information

Our audited consolidated financial statements were prepared in accordance with International Financial Reporting Standards (which we refer to as IFRS), as issued by the International Accounting Standards Board (which we refer to as the IASB), and audited in accordance with auditing standards generally accepted in the United States of America established by the Public Company Accounting Oversight Board (which we refer to as the PCAOB).

Our fiscal year ends on December 31 of each year as does our reporting year. Therefore, any references to 2023, 2022 and 2021 are references to the fiscal and reporting years ended December 31, 2023, December 31, 2022 and December 31, 2021, respectively. See Note 2 to our audited consolidated financial statements as of and for the years ended December 31, 2023, 2022 and 2021, and Note 2 to our unaudited condensed interim consolidated financial statements as of June 30, 2024 and for the six months ended June 30, 2024 and 2023, included elsewhere in this prospectus, for a discussion of the basis of preparation of our financial statements.

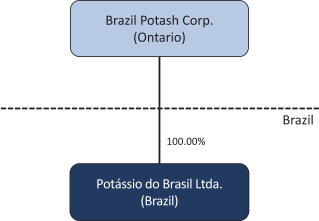

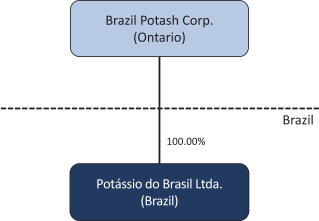

Our Companys functional currency and reporting currency is the U.S. dollar, the legal currency of the United States (USD, US$ or $). Our local subsidiary in Brazil, Potássio do Brasil Ltda., determines its own functional currency based on its own circumstances. The functional currency of Potássio do Brasil Ltda. is the Brazilian real (R$).

Rounding

Certain figures and some percentages included in this prospectus have been subject to rounding adjustments. Accordingly, the totals included in certain tables contained in this prospectus may not correspond to the arithmetic aggregation of the figures or percentages that precede them.

Reverse Stock Split and Share Consolidation

In July 2024, our board of directors and our stockholders approved a reverse stock split and share consolidation of our Common Shares in a range of up to five for one, which reverse stock split and share consolidation was effected on , 2024 in a reverse stock split ratio of -for-1 (which we refer to as the Reverse Stock Split and Share Consolidation). The Reverse Stock Split and Share Consolidation combined each outstanding Common Shares into one Common Share. Any fractional shares resulting from the Reverse Stock Split and Share Consolidation were rounded down to the nearest whole Common Share, and no cash or other consideration was paid in lieu of any fractional shares. All references to our Common Shares, common share purchase warrants, stock options, deferred share units, restricted stock units, share data, per share data, and related information in this prospectus have been retroactively adjusted, where applicable, to reflect the Reverse Stock Split and Share Consolidation as if it had occurred at the beginning of the earliest period presented.

Mineral Disclosure

As used in this prospectus, references to the Technical Report are to the Technical Report, Update of the Autazes Potash ProjectPre-Feasibility Study (dated October 14, 2022) with respect to our potash mining project located in the Amazon potash basin near the city of Autazes (which we refer to as the Autazes Project), which was prepared by ERCOSPLAN Ingenieurgesellschaft Geotechnik und Bergbau mbH (which we refer to as

ii

Table of Contents

ERCOSPLAN) in accordance with the requirements of subpart 1300 of Regulation S-KDisclosure by Registrants Engaged in Mining Operations (which we refer to as the SEC Mining Modernization Rules) under the Securities Act of 1933, as amended (which we refer to as the Securities Act), which governs disclosure for registrants with material mining operations. Certain numeric values describing the Autazes Project disclosed herein have been converted from the metric system of measurement, which is used in the Technical Report, to the imperial system of measurement commonly used in the United States. A summary of the Technical Report is included as Exhibit 96.1 to our registration statement of which this prospectus forms a part.

Additionally, we have filed a prospectus with the securities regulatory authorities in each of the provinces and territories of Canada, other than Quebec, in connection with the initial public offering of our Common Shares in Canada. As part of this filing process, ERCOSPLAN has also prepared the Technical Report, Update of the Autazes Potash ProjectPre-Feasibility Study (dated October 14, 2022) with respect to the Autazes Project, which was prepared in accordance with Canadian National Instrument 43-101Standards of Disclosure for Mineral Projects (which we refer to as NI 43-101), and will be filed with Canadian securities regulatory authorities in accordance with NI 43-101. NI 43-101 is an instrument, developed by the Canadian Securities Administrators and administered by the provincial and territorial securities commissions in Canada, that governs how issuers in Canada publicly disclose scientific and technical information about their mineral projects.

For the meanings of certain technical terms used in this prospectus, see the Annex to this prospectus, Glossary of Technical Terms.

Market and Industry Data

This prospectus contains references to market data and industry forecasts and projections, which were obtained or derived from publicly available information, reports of governmental agencies, market research reports, and industry publications and surveys. These sources generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe such information to be accurate, we have not independently verified the data from these sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties and risks regarding the other forward-looking statements in this prospectus due to a variety of factors, including those described in the sections entitled Cautionary Note Regarding Forward-Looking Statements and Risk Factors and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in the forecasts and projections. For the avoidance of doubt, nothing stated in this paragraph operates to relieve our Company or the underwriters from liability under applicable securities laws for any misrepresentation contained in this prospectus.

For Investors Outside of the United States and Canada

Neither we nor the underwriters have done anything that would permit this offering, or the possession or distribution of this prospectus, in any jurisdiction where action for that purpose is required, other than in the United States and Canada. You are required to inform yourselves about, and observe any restrictions relating to, this offering and the distribution of this prospectus. Our Common Shares offered by this prospectus may not be offered or sold, directly or indirectly, nor may this prospectus or any other offering materials in connection with the offer or sale of such securities be distributed or published, in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of such jurisdiction.

iii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this prospectus, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as may, will, should, believe, expect, could, intend, plan, anticipate, estimate, continue, predict, project, potential, target, goal or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements in this prospectus include, but are not limited to, statements with respect to:

| | our ability to achieve profitability in the future; |

| | our ability to obtain the necessary permits and licenses for the Autazes Project, and the timing and possible outcome of pending regulatory and permitting matters; |

| | proposed expenditures for exploration work, and general and administrative expenses; |

| | the development and construction of the Autazes Project; |

| | maintaining rights of access to, including successfully acquiring, leasing, purchasing and/or obtaining rights to occupy, the land for the development and operation of the Autazes Project; |

| | our capital requirements and need for additional financing, and our ability to raise additional capital; |

| | the estimated results of planned development, mining and production activities; |

| | the estimated results of our GHG Emissions Analysis (as defined herein); |

| | the supply and demand of potash; |

| | general economic and financial conditions; |

| | governmental regulation of mining operations and related matters; |

| | our prospects, strategies, and business objectives and milestones; |

| | industry trends; and |

| | our use of net proceeds from this offering and other available funds. |

We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this prospectus under the headings Risk Factors, Managements Discussion and Analysis of Financial Condition and Results of Operations and Business, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this prospectus. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this prospectus include:

| | the need for significant capital resources for the development and construction of the Autazes Project; |

| | the cost, timing, and results of our future development, mining and production activities; |

| | our ability to obtain the necessary permits and licenses for the Autazes Project, including that, once obtained, such permits and licenses may be terminated or not renewed by governmental authorities; |

iv

Table of Contents

| | our ability to maintain rights of access to, including to successfully acquire, lease, purchase and/or obtain rights to occupy, the land for the development and operation of the Autazes Project; |

| | issues with the urban areas, rural communities, and indigenous communities which surround our operations and the procedures required for their prior consultation; |

| | our ability to manage our development, growth and operating expenses; |

| | our lack of operating history on which to judge our business prospects and management; |

| | the possible material differences between our estimates of Mineral Reserves and the mineral quantities we will actually recover; |

| | lower than expected metallurgical assumptions; |

| | mining industry operational risk, such as operator errors, mechanical failures and other accidents, including risks relating to tailings impoundments; |

| | environmental, social and governance impacts and risks with respect to the development and operation of the Autazes Project; |

| | availability of capable labor near the mine of the Autazes Project; |

| | our ability to compete and succeed in competitive potash mining industry; |

| | our ability to raise capital and the availability of future financing; |

| | changes in Brazilian and international governmental and regulatory policies that apply to our operations; |

| | fluctuations in the currency exchange rate between the U.S. dollar or Canadian dollar and the Brazilian real; |

| | the risks and uncertainties relating to Brazilian and international economic and political conditions; and |

| | potential delays in the different developmental and operational phases of the Autazes Project. |

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this prospectus. The forward-looking statements contained in this prospectus are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this prospectus, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this prospectus speaks only as of the date of this prospectus. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this prospectus, whether as a result of new information, future events or otherwise, after the date of this prospectus.

v

Table of Contents

This summary highlights selected information presented in greater detail elsewhere in this prospectus, but does not include all the information you should consider before investing in our Common Shares. You should read this summary together with the more detailed information appearing elsewhere in this prospectus, including our audited financial statements and the related notes thereto, our unaudited condensed interim consolidated financial statements and the related notes thereto, and the sections entitled Risk Factors and Managements Discussion and Analysis of Financial Condition and Results of Operations. Some of the statements in this summary and elsewhere in this prospectus constitute forward-looking statements. See Cautionary Note Regarding Forward-looking Statements.

Business Overview

We are a mineral exploration and development company with a potash mining project (which we refer to as the Autazes Project) located in the state of Amazonas, Brazil. Our technical operations are based in Autazes, Amazonas, Brazil and Belo Horizonte, Minas Gerais, Brazil, and our corporate office is in Toronto, Ontario, Canada. We are in the pre-revenue development stage and have not yet commenced any mining operations. Our plan of operations for the next few years includes securing all required environmental licenses for the Autazes Project, and, subject to securing sufficient funds, commencing all phases of the construction of the Autazes Project.

Once our operations commence, our operating activities will be focused on the extraction and processing of potash ore from the underground mine of the Autazes Project and selling and distributing the processed potash in Brazil.

Organizational Structure

Our organizational structure is as follows:

Description of our Mineral Property

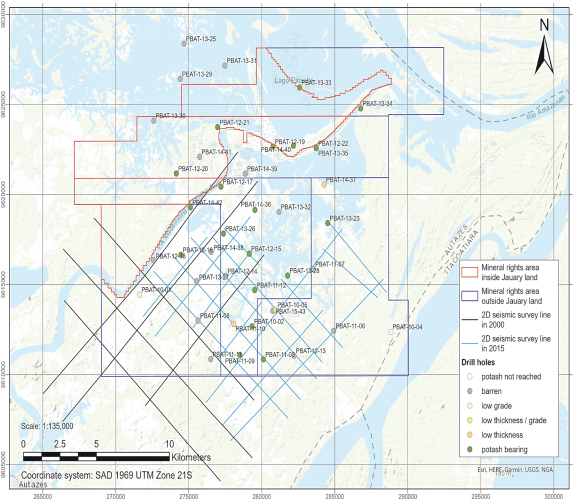

The Mineral Resources on the property on which the Autazes Project is situated (which we refer to as the Autazes Property) are in an area encompassing approximately 98 square miles located in the Amazon potash basin near the city of Autazes in the eastern portion of the state of Amazonas, Brazil, within the Central Amazon Basin, between the Amazon River and the Madeira River, approximately 75 miles southeast of the city of Manaus, northern Brazil. We hold all of the mineral rights for the Autazes Project through our wholly-owned local subsidiary in Brazil, Potássio do Brasil Ltda., and such mineral rights are registered with Brazils national mining regulatory authority, Agência Nacional de Mineração (which we refer to as the Brazilian National

1

Table of Contents

Mining Agency), which is a specialized agency of the Brazilian Ministry of Mines and Energy. Under our current development plan for the Autazes Project, we intend to own, lease, have rights of access to or have rights to occupy, through Potássio do Brasil Ltda., 39 rural properties on which the facilities and infrastructure for the Autazes Project will be located. We currently have rights of access to 24 rural properties consisting of a total area of approximately 5.4 square miles, which include the land on which our proposed mine shafts, processing plant, and port for the Autazes Project will be constructed. We intend to conduct administrative land regularization proceedings with applicable Brazilian governmental agencies (such as the Brazilian Institute of Settlement and Land Reform, the Brazilian Ministry of Industry and Trade, and other agencies), the purpose of which is to acquire ownership of these 24 properties. The land regularization proceedings will generally be conducted in accordance with Decree No. 74965/1974, Opinion CGU/ AGU dated as of August 23, 2010, issued by the General Counsel of the Federal Government Office of Brazil (which we refer to as Opinion CGU/AGU), which governs the acquisition or lease of rural properties in Brazil by foreign individuals or legal entities, as well as Brazilian legal entities controlled by foreign investors or with the majority of their capital stock held by foreign investors, such as in the case of Potássio do Brasil Ltda. Under current Brazilian laws and regulations, we may only acquire or lease rural property in Brazil, without violating Opinion CGU/AGU, if certain conditions are met, including, among others, that (i) we obtain approvals from the Brazilian Institute of Settlement and Land Reform and from the applicable Brazilian Ministries; (ii) the aggregate amount of rural property held by us does not exceed 25% of the total surface area of the municipality in which such property is located; and (iii) the acquisition must be formalized by means of a public deed of sale and purchase. See also Risk FactorsRisks Related to MiningOur mining operations may be impaired due to restrictions on the acquisition or lease of rural properties by foreign investors or by Brazilian entities under foreign control or with the majority of its capital stock held by foreign persons.

Additionally, in March, April and May 2024, we entered into agreements to lease, for a term of six years, the remaining 15 rural properties consisting of a total area of approximately 4.2 square miles, which primarily will be used for the sites of our dry stacked tailings piles (see also BusinessForeign Investment Restrictions and ControlForeign Investment Restrictions). Each of these lease agreements also provides us with a right of first refusal to purchase the applicable leased property in the event of a sale of such property, and in connection with any such sale, we will be able to apply the aggregate amount paid under such lease agreement as a reduction in the sale price.

Furthermore, any new acquisitions or leases of rural lands would also be subject to restrictions on foreign-controlled entities, as described in Risk FactorsRisks Related to MiningOur mining operations may be impaired due to restrictions on the acquisition or lease of rural properties by foreign investors or by Brazilian entities under foreign control or with the majority of its capital stock held by foreign persons. For additional information regarding our planned land ownership, see Description of the Autazes Project and the Autazes PropertyOwnership of Land.

Substantial work has been completed to develop and de-risk the Autazes Project. We engaged ERCOSPLAN Ingenieurgesellschaft Geotechnik und Bergbau mbH, an engineering consulting firm with significant experience in the potash mining industry (which we refer to as ERCOSPLAN), to prepare the Technical Report, which includes Mineral Resource and Mineral Reserve estimates and capital construction, operation and economic estimates. To date, 43 exploration holes totaling approximately 121,000 feet have been drilled on the Autazes Property, and the results from these drill holes form the basis of the Technical Report, prepared in accordance with the SEC Mining Modernization Rules, which govern disclosure for registrants with material mining operations.

For additional information regarding the Autazes Project, the Autazes Property, and the Technical Report, see Description of the Autazes Project and the Autazes Property.

2

Table of Contents

Regulatory Overview

Brazilian Mining Regulations

Under the Brazilian Constitution, all Mineral Resources are initially the property of the Federal Government of Brazil until applicable permits, licenses, concessions, and mineral rights are granted to qualified and approved mining applicants. The right to explore and exploit Mineral Resources in Brazil are regulated by the Brazilian National Mining Agency under Brazilian Decree-Law No. 227/1967 (which we refer to as the Brazilian Mining Code), regulated by Brazilian Decree No. 9.406/2018, and applicable policies of the Brazilian Ministry of Mines and Energy. Only Brazilian citizens, or legal entities incorporated in Brazil under Brazilian law, may be entitled to conduct mining activities, including commercially exploiting Mineral Resources, in Brazil.

In order to develop, construct, and commence the mining operations of the Autazes Project, we must undertake a licensing process pursuant to which the applicable federal, state, or municipal environmental authorities in Brazil will license, approve and authorize the location, exploration and development activities, construction, and operation of the Autazes Project. It is not always clear which level of government or regulatory agency in Brazil has authority over the environmental licensing of mining projects, and therefore, we believe that it would not be unusual if certain Brazilian regulatory agencies challenge the regulatory authority of certain other Brazilian environmental agencies over environmental licensing of mining projects, which may create uncertainties as to whether the Autazes Project should be licensed by Brazilian federal or state environmental agencies. Public prosecutors also have influence on such challenges or disputes, including through judicial actions.

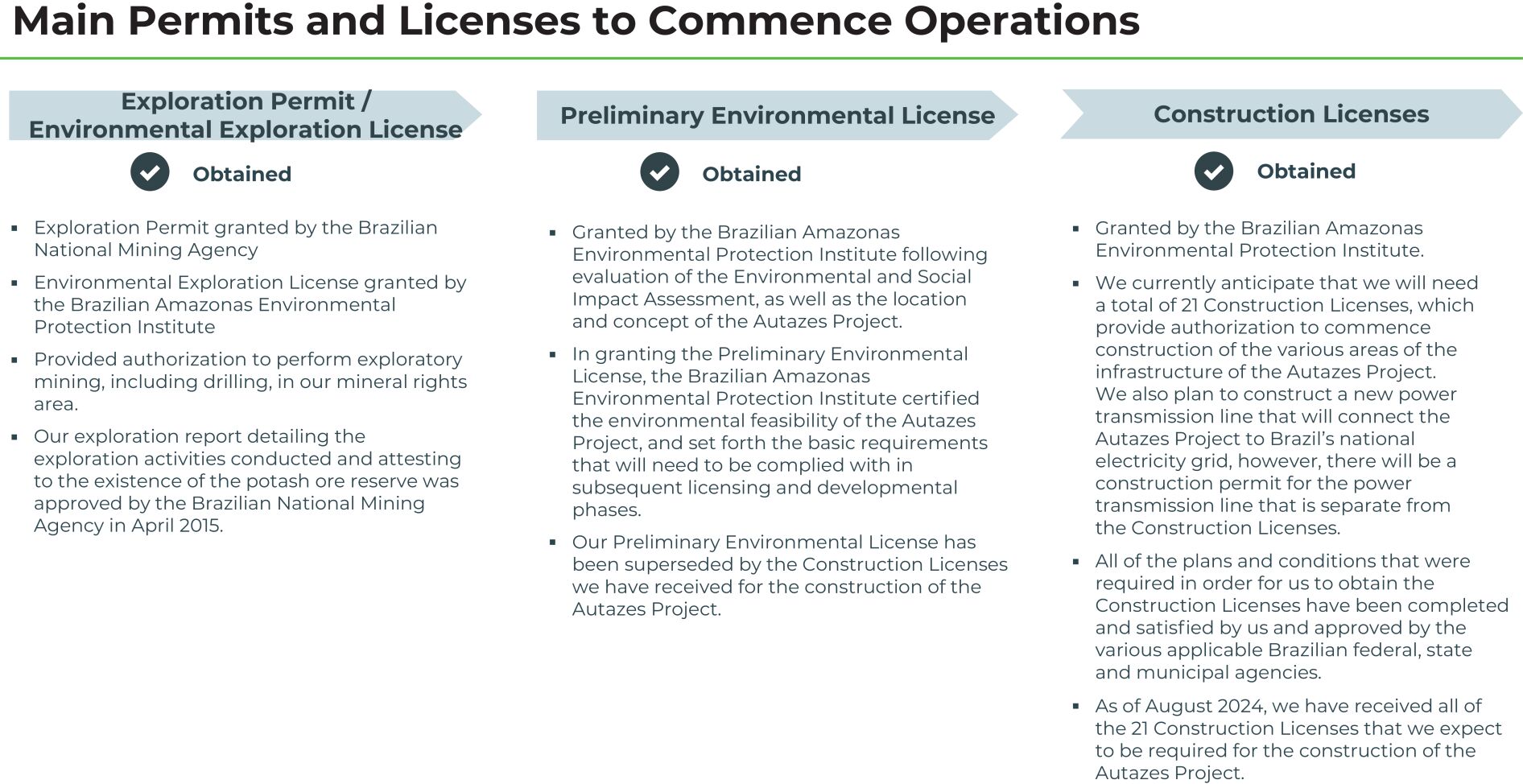

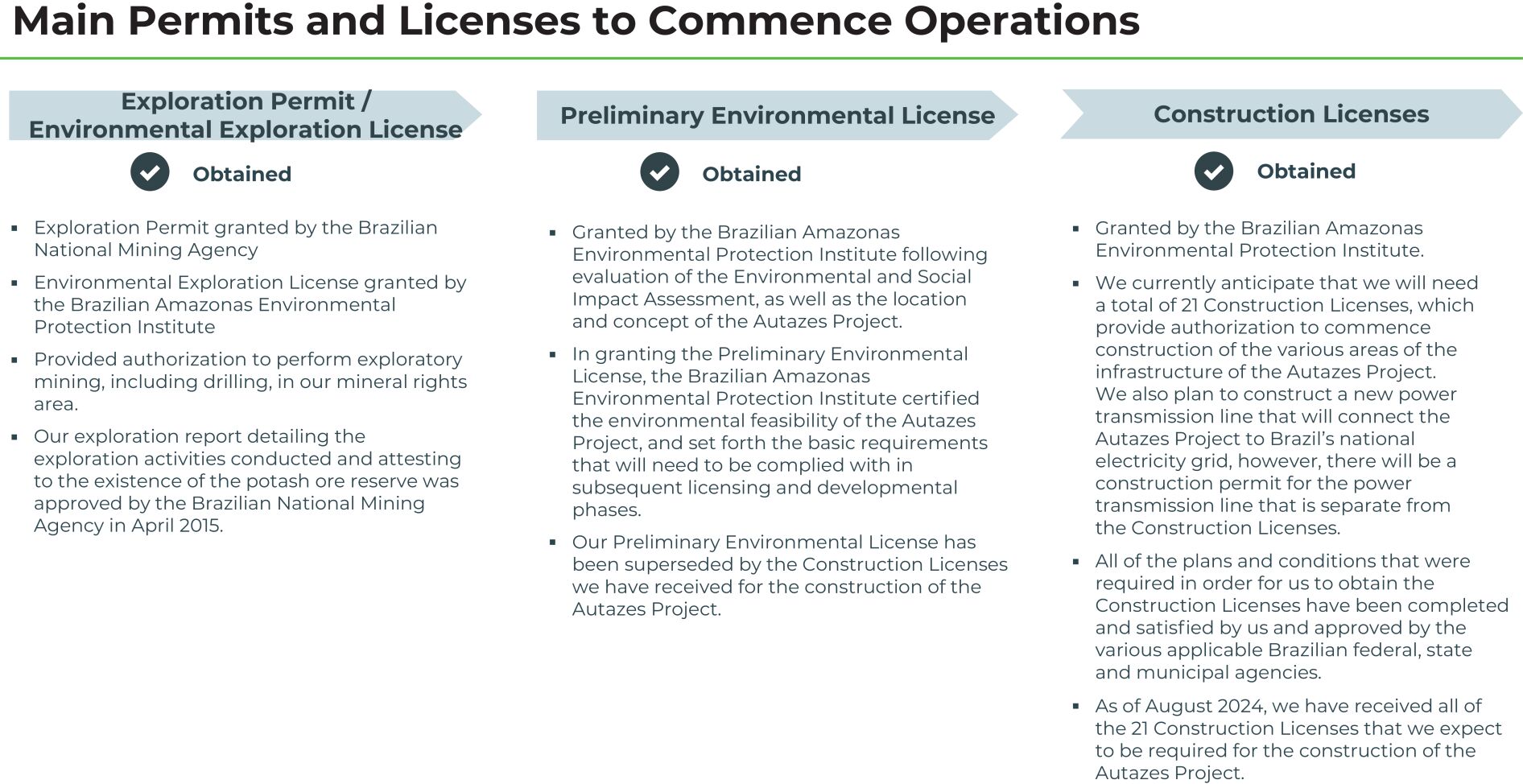

Exploration Permits and Environmental Exploration License

In order for us to perform exploratory mining activities in Brazil, we first had to obtain specific permits called Alvará de Pesquisa (which we refer to as our Exploration Permits) from the Brazilian National Mining Agency, and a specific license called Licença de OperaçãoExploração (which we refer to as our Environmental Exploration License) from the Instituto de Proteção Ambiental do Amazonas (IPAAM) (which we refer to as the Brazilian Amazonas Environmental Protection Institute), which is the environmental protection agency for the state of Amazonas, Brazil. We received a total of five Exploration Permits from July 2009 to September 2011, and our Environmental Exploration License in June 2009, which allowed us to perform exploration activities, including drilling, in our mineral rights area on the Autazes Property. Following the completion of our exploration work for the Autazes Project, we submitted to the Brazilian National Mining Agency for approval a final exploration report detailing the exploration activities conducted and attesting to the existence of the potash ore reserve. The Brazilian National Mining Agency approved our final exploration report in April 2015, and this approval enables us to request a mining concession, which, if approved, will permit mining and mineral exploitation activities, as described under Mining Concession below.

Environmental Licenses

There are three general types of environmental licenses that mining companies are required to obtain in order to be fully authorized to construct and operate a mine in Brazil, each of which is described below.

Preliminary Environmental License. The first type of environmental license is called Licença Prévia (which we refer to as our Preliminary Environmental License), which we initially obtained during the planning phase of the Autazes Project. In connection with our application to obtain our Preliminary Environmental License, we engaged Golder Associates Inc., a consulting firm with significant experience in helping companies develop and enact environmental and sustainability measures (which we refer to as Golder), to prepare an environmental and social impact assessment of the Autazes Project (which we refer to as the Environmental and Social Impact Assessment), and we and Golder participated in public hearings and conducted several rounds of consultations with local indigenous communities near the Autazes Project in accordance with the guidelines and requirements established by Fundação Nacional do Índio (which we refer to as FUNAI), which is Brazils governmental protection agency that establishes

3

Table of Contents

and carries out policies relating to indigenous peoples in Brazil. Following the completion of the Environmental and Social Impact Assessment in January 2015, we submitted it to the Brazilian Amazonas Environmental Protection Institute in connection with our application to obtain our Preliminary Environmental License. In July 2015, we received our Preliminary Environmental License for the Autazes Project from the Brazilian Amazonas Environmental Protection Institute, and, as part of the application and approval process, the Brazilian Amazonas Environmental Protection Institute evaluated the Environmental and Social Impact Assessment, as well as the location and concept of the Autazes Project, certified the environmental feasibility of the Autazes Project, and set forth the basic requirements that will need to be complied with in subsequent licensing and developmental phases.

Additionally, Brazil is a signatory to International Labour Organization Convention 169 (also known as the Indigenous and Tribal Peoples Convention (1989)), which is the major binding international convention concerning indigenous and tribal peoples, and sets standards for national governments regarding indigenous peoples economic, socio-cultural and political rights, which include the right to prior and informed consultation on any development activity that may impact indigenous peoples land and/or lives. In March 2017, we agreed to conduct additional consultations with the local Mura indigenous people (who make up the vast majority of the indigenous communities, villages and tribes near the Autazes Project) in accordance with International Labour Organization Convention 169. Such additional consultations were intended to provide the local Mura indigenous communities with an opportunity to learn about the Autazes Project, and to inform them about the potential impact of the development of the Autazes Project on their communities and way of life and our proposed plans to mitigate any negative impacts. The Mura indigenous communities invited 36 Mura villages to participate in such additional consultations, and established their own consultation and voting protocol, which provided that, in order to approve a resolution to support our environmental licensing process and the advancement of the Autazes Project: (i) at least 60% of the 36 villages was required to participate in a vote in order to establish a quorum and call for a valid vote amongst the local Mura indigenous communities; (ii) each village that participated in such vote was to be represented by six villagers, with each villager having one vote; and (iii) an affirmative vote of at least 60% of the votes cast was required to approve such resolution. In September 2023, we completed such additional consultations with the local Mura indigenous communities. Out of the 36 villages that comprise the local Mura indigenous communities, 34 villages participated in a vote, and over 90% of the eligible villagers participating in such vote affirmatively voted to approve a resolution, to support our environmental licensing process and the advancement of the Autazes Project. Furthermore, based on feedback from such consultations, we are currently working with the Mura indigenous people to develop a mutually agreed upon impact benefit agreement outlining commitments that we will undertake to benefit all 36 villages and their local communities (which we refer to as the Impact Benefit Agreement).

Our Preliminary Environmental License has been superseded by the Construction Licenses that we have received for the construction of the Autazes Project (see Construction Licenses below).

Construction Licenses. We refer to the second type of environmental license, collectively, as the Construction Licenses, which are comprised of (i) licenses called Licença de Instalação (which we refer to collectively as the Installation Licenses), (ii) licenses called Licença Ambiental Única (which we refer to collectively as the Specific Environmental Licenses), and (iii) environmental authorizations (which we refer to collectively as the Fauna Authorizations). We currently anticipate that we will need a total of 21 Construction Licenses in connection with the construction of the Autazes Project. There are a total of seven Installation Licenses, which correspond to the following various areas of the infrastructure of the Autazes Project: (i) mine, (ii) potash processing plant and dry stacked tailings piles, (iii) roads, (iv) river barge port and potash stockpile at the port, (v) water distribution and supply, (vi) sewage treatment, and (vii) sanitary landfill. We also plan to construct a new power transmission line that will connect the Autazes Project to Brazils national electricity grid, however, there will be a construction permit for the power transmission line that is separate from the Installation Licenses. There are a total of nine Specific Environmental Licenses, which relate to earthworks, vegetation suppression and water source drilling, and a total of five Fauna Authorizations, which relate to the capture and rescue of wild fauna, at these various infrastructure areas. In this phase of the environmental licensing process, the basic environmental plan outlining pollution control and compensatory

4

Table of Contents

measures are submitted to the Brazilian Amazonas Environmental Protection Institute for its review and approval. All of the plans and conditions that were required in order for us to obtain the Construction Licenses have been completed and satisfied by us and approved by the various applicable Brazilian federal, state and municipal agencies.

As of August 2024, we have received from the Brazilian Amazonas Environmental Protection Institute all of the 21 Construction Licenses that we expect to be required for the construction of the Autazes Project. See also Current Status of our Licensing Process below.

Operational License. The third type of environmental license is called Licença de Operação (which we refer to as the Operational License), which is the last phase of the environmental licensing process necessary to operate a mine in Brazil. The Brazilian Amazonas Environmental Protection Institute will review and consider any application for an Operational License, and will decide whether to issue this license following construction of the mining project. The Operational License is required for us to be able to perform mining and mineral exploitation activities in our mineral rights area, as well as sell the produced potash.

Mining Concession

At such time when we complete the construction of the Autazes Project, and we have received the Operational License, we believe that we will receive the mining concession called Concessão de Lavra (which we refer to as the Mining Concession), which is granted by the Brazilian Ministry of Mines and Energy. In connection with the Mining Concession, we previously prepared and submitted a plan called Plano de Aproveitamento Econômico (PAE) (which we refer to as our Plan for Economic Development of the Deposit), which has been approved by the Brazilian National Mining Agency. The Mining Concession will be granted based upon and in accordance with the approved Plan for Economic Development of the Deposit. As the holder of the Mining Concession, we will have exclusive rights to undertake mining operations for the Mineral Resources specified in the Mining Concession within the authorized mineral rights area. The Mining Concession will be valid until the depletion of the mineral deposit, as long as the holder complies with the obligations and requirements under applicable Brazilian mining regulations. Although mineral deposits in Brazil are federal property, a mining concession holder is the assured owner of the extracted mineral.

As the holder of the Mining Concession, we will have a range of obligations, including to: (i) start the mining work, in accordance with the development and mining plan approved by the Brazilian National Mining Agency, within six months from the date of publication of the Mining Concession in the Official Gazette of the Brazilian federal executive; (ii) carry out the mining work in accordance with the approved development and mining plan; (iii) extract only the minerals indicated in the Mining Concession or any addendum thereto; (iv) communicate to the Brazilian National Mining Agency the discovery of any mineral substance not included in the Mining Concession; (v) carry out the mining work in accordance with applicable laws, rules and regulations; (vi) appoint a duly qualified person to supervise the mining work; (vii) refrain from intentionally obstructing or hampering the future development of the mineral deposit; (viii) be liable for any loss or damage caused to third parties resulting from the mining work; (ix) not cause air or water pollution as a result of the mining work; (x) protect and preserve water sources, as well as to use them in accordance with applicable technical instructions and requirements; (xi) observe and comply with all instructions and recommendations of applicable regulatory authorities; (xii) refrain from suspending the mining work for more than six months without the prior consent of the Brazilian National Mining Agency; (xiii) keep the mine in good condition during any suspension period; (xiv) rehabilitate the areas degraded by mining; (xv) pay royalties; and (xvi) comply with the provisions of the Brazilian National Dams Safety Policy.

Once commercial production of potash commences, we will be required to pay financial compensation for such mineral exploitation (Compensação Financeira pela Exploração Mineral) in the form of a royalty (which we refer to as the Mining Royalty), currently at a rate of 2% of our gross revenue, which will be divided among various Brazilian federal, state and municipal governmental offices and agencies, including the Brazilian

5

Table of Contents

National Mining Agency and other environmental agencies, as determined by Brazilian law and regulations. Additionally, we will be required to pay a royalty equal to 50% of the Mining Royalty to the owners of any land not owned by our Company or Potássio do Brasil Ltda.

Additionally, the Brazilian National Mining Agency is allowed to grant mining easements (servidões minerárias) in properties of third parties in relation to a given mining title, provided that such mining easement is necessary for the proper exploration and exploitation of the mineral deposit. After the granting of an easement by the Brazilian National Mining Agency, through the issuance of a Public Utility Statement, the holder of the mining title to which the Public Utility Statement refers must pay an indemnification amount to the owner of the servient property before entering such property. If such indemnification amount cannot be agreed upon between the holder of the mining title and the property owner, it will be determined by a court.

Once the exploitation of the mineral deposits has been concluded, the corresponding mining area must be rehabilitated in accordance with appropriate environmental and mine closure plans included as part of our Plan for Economic Development of the Deposit which was approved by the Brazilian National Mining Agency.

Current Status of our Licensing Process

Our current near-term goal is to start the primary construction of the infrastructure of the Autazes Project. We will not be able to obtain the Operational License or the Mining Concession until construction of the Autazes Project has been completed. Additionally, opposition by any governmental or non-governmental organizations to our proposed development or operations of the Autazes Project, such as the May 2024 Civil Lawsuit, may, among other things, result in delays or a shutdown of our development of the Autazes Project and require us to spend significant amounts of time and resources to resolve any such issues in order to secure or maintain necessary permits and licenses. See also Risk FactorsRisks Related to our CompanyWe may face potential opposition to the Autazes Project, which could increase our operating costs or result in substantial delays or a shutdown of the Autazes Project and BusinessLegal Proceedings.

6

Table of Contents

The following summarizes the various permits and licenses that are required in order to be fully authorized to operate a mine in Brazil:

Environmental Regulations

Our exploration and development activities are, and our future mining operations will be, subject to environmental laws and regulations in Brazil. We currently, and will continue to, maintain an operating policy that seeks to comply with all applicable environmental laws and regulations.

For additional information regarding the mining and environmental rules and regulations applicable to us and our proposed operations, including a more detailed description of the main permits and licenses that mining companies are required to obtain in order to be fully authorized to operate a mine in Brazil, see BusinessRegulatory Overview. See also Risk FactorsRisks Related to Mining.

7

Table of Contents

Our Competitive Strengths

We believe that the following competitive strengths, among others, will position us for future operational success:

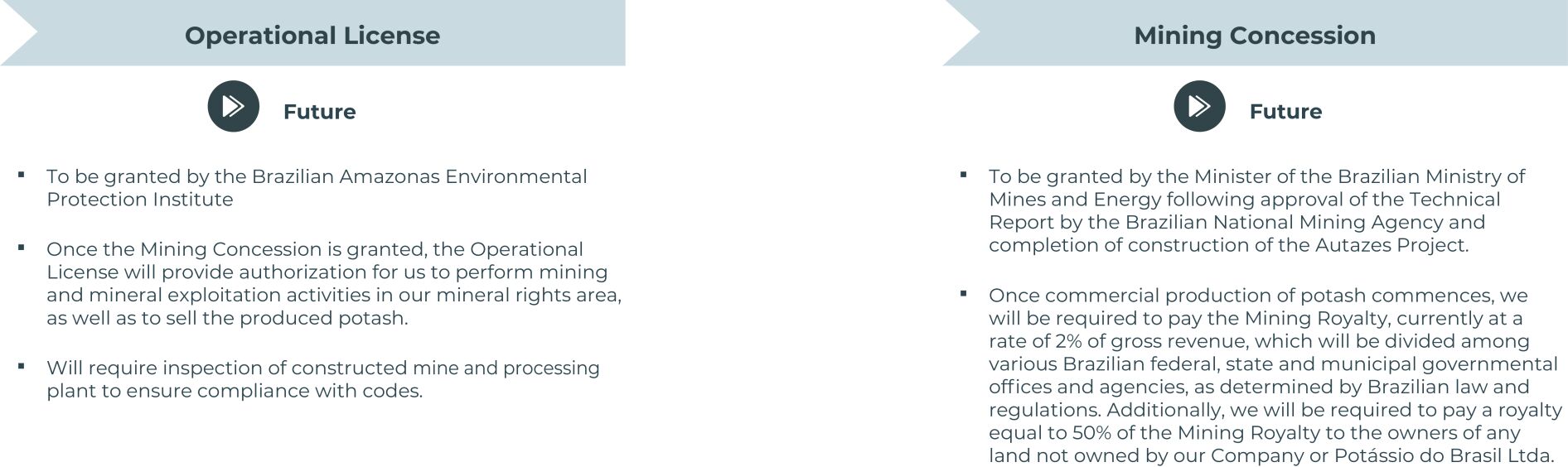

| | Strategic in-country location of the Autazes Project. The Autazes Project is located close to Brazils existing agricultural and farming areas and near the Amazon River system, thus enabling a shorter and more efficient inland path to Brazilian farmers, with the initial leg by river barge and the final leg by truck. We believe that the average total transit time to transport our potash product from the Autazes Project to domestically located customers in Brazil will be approximately two and a half days, which is approximately 43 times shorter than the transit time of up to 107 days that it takes to transport potash from other major potash producing suppliers in Canada and Russia to customers in Brazil. The state of Mato Grosso, Brazil is the largest consumer of potash among all states in Brazil and is responsible for more than 20% of domestic potash consumption. The state of Mato Grosso also shares a border with, and is a short distance from, the state of Amazonas, Brazil, where the Autazes Project is located. With expected at-scale production of an average of approximately 2.4 million tons of muriate of potash (which we refer to as MOP) per year, we believe that the Autazes Project should reduce Brazils reliance on imported potash, which made up approximately 98% of all potash used in Brazil in 2021. We believe that the Autazes Project is the only pre-revenue development stage or development stage potash project of significant size in Brazil, and we believe that it could eventually supply approximately 20% of Brazils current demand for potash. |

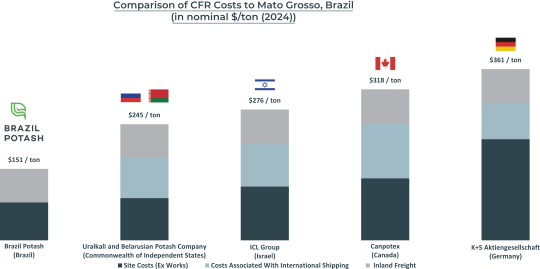

| | Lowest anticipated delivered cost to farmers. We estimate that the delivered cost of potash from the Autazes Project to Brazilian farmers will be approximately half of the average cost of potash imported into Brazil, and we believe that we will be profitable at prices where approximately 70% of existing potash producers outside of Brazil would not be profitable. Potash imported into Brazil has a substantially higher marginal delivered cost than potash produced in Brazil, providing a margin advantage for domestic potash producers, particularly in our case since the Autazes Project is only five miles from a major river system. This provides us with a structural margin advantage given Brazils current reliance on imported potash, and market pricing that reflects elevated import costs. |

8

Table of Contents

The chart below reflects a comparison of our estimated cost and freight (CFR) costs of delivering our potash product to farmers in the state of Mato Grosso, Brazil, against the estimated CFR costs of certain current major international producers and exporters of potash delivering their potash to Mato Grosso, based on the following: (i) international shipping costs include road and/or rail freight costs from the respective production plants of such competitors to the respective ports in those countries, ocean freight costs, port charges (operation and demurrage), and ad hoc handling expenses, (ii) inland freight costs to Mato Grosso includes either freight costs from the Paranaguá port in Brazil to Mato Grosso (with respect to imported potash produced by our competitors), or inland road transportation costs from the Autazes Project to Mato Grosso (with respect to potash to be produced by us at the Autazes Project), and (iii) all road, rail, and ocean freight costs and port charges are estimated by CRU Group, a business intelligence company focused on the global mining, metals and fertilizers industries (which we refer to as CRU).

Source: the Technical Report.

| | Competitively advantaged carbon emissions profile. Based on an analysis we commissioned from a consulting firm to assess the greenhouse gas (which we refer to as GHG) emissions anticipated to be generated by the Autazes Project (which we refer to as our GHG Emissions Analysis), we believe that the Autazes Project will have a competitively advantaged GHG emissions profile from its anticipated operations in the following three material ways: (i) as compared to a potash producer located in Saskatchewan, Canada (which, according to our GHG Emissions Analysis, has a lower GHG emissions profile than the potash producers in other countries currently supplying potash to Brazil) using similar conventional underground mining methods (which are generally more energy efficient than alternative potash mining methods) and exporting an amount of potash to Brazil equal to the amount of potash that we anticipate producing, we believe that the aggregate Scope 2 GHG Emissions generated from the production of potash from the Autazes Project will be approximately 1.2 million tons (or approximately 80%) less per year, since we plan to have all of the electricity used at the Autazes Project be provided by Brazils national power grid, which generates approximately 80% of its power from renewable sources and has a lower carbon intensity of approximately 0.54 ton of carbon dioxide (CO2) equivalent per megawatt hour (which we refer to as tCO2e/MWh), as compared to the power supply relied upon by a Saskatchewan potash producer (assuming such potash producer draws all of its power consumption from the Saskatchewan provincial power grid, which currently generates approximately 81% of its power from fossil fuels); (ii) assuming the same amount of potash that is |

9

Table of Contents

| currently being imported into Brazil and the current geographic supplier mix, we believe that the Scope 3 GHG Emissions associated with the distribution of our potash product and related logistics at the Autazes Project will be approximately 205,000 tons less per year than the average Scope 3 GHG Emissions produced by overseas potash producers currently importing potash into Brazil, primarily because the distances to transport our potash product to Brazilian farmers will be significantly shorter than those of the overseas suppliers; and (iii) based on the assumption that the local communities surrounding the Autazes Project use 3MWh of electricity per year, which is currently exclusively supplied by diesel generators, we believe that annual GHG emissions will be reduced since, following completion of the planned power transmission line that will connect the Autazes Property to Brazils national power grid, the local communities will be able to connect to the new electricity infrastructure and draw power from Brazils national power grid. As such, based on the three examples described above, we believe that the Autazes Project will result in an aggregate of approximately 1.4 million tons less GHG emissions being produced per year, which is the equivalent of planting approximately 56 million new trees (assuming an average annual CO2 sequestration of 50 pounds per tree). We believe that having a significant role in helping produce the lowest possible carbon footprint in a rapidly decarbonizing world is a strong competitive advantage. For additional information regarding our GHG Emissions Analysis, see BusinessEnvironmental, Social and GovernanceClimate-related Risks and Opportunities (including GHG Emissions and Energy Management). |

| | Advancement of the Autazes Project to a near construction ready state. We have raised over $240 million through equity and debt financings for the development of the Autazes Project and have progressed it to a near construction ready state. The Environmental and Social Impact Assessment and the Technical Report have already been completed, and we have received all of the 21 Construction Licenses that we expect to be required for the construction of the Autazes Project. We currently have rights of access to, and intend to own or have rights to occupy, a significant amount of the land planned for the Autazes Project, including all of the land on which the planned mine shafts, processing plant and port will be located, and we have entered into agreements to lease, for a term of six years, with a right of first refusal option to purchase, the remaining properties on which the other facilities for the Autazes Project (primarily consisting of the sites for our dry stacked tailings piles) will be located. |

| | The development of the Autazes Project is a priority for Brazil. The Autazes Project was designated as a project of National Importance by Brazils Federal Government and National Observatory in September 2020. Additionally, in September 2021, the Federal Government of Brazil admitted the Autazes Project into the Brazilian Investment Partnership Program, which provides us with direct access to Brazils Attorney General to provide support on legal matters, and indicates that the Autazes Project should be a top priority for government officials in terms of their review of our permit and license applications. |

| | Experienced and highly knowledgeable leadership team. We have an expert management team with significant development and operational experience at some of the worlds largest natural resource companies, as well as marketing, sales and business development experience at major potash companies. We boast support from an experienced natural-resource focused investor base and have relationships with some of the largest domestic Brazilian agribusinesses. Our Executive Chairman, Stan Bharti, has a strong operational and capital raising background with over 15 years of experience acquiring, restructuring, and financing mining assets. In 2011, Forbes & Manhattan, Inc., the private merchant bank that Mr. Bharti established in 2002, sold its stake in Consolidated Thompson Iron Mines to Cliffs Natural Resources Inc. for $4.9 billion in cash. Mr. Bharti has a significant amount of experience in Brazil including being part of the team that turned around the Jacobina gold mine in 2002 to then sell it for $500 million in 2006 to Yamana Gold. Our Chief Executive Officer, Matthew Simpson, previously worked at the Iron Ore Company of Canada, a subsidiary of Rio Tinto and Mitsubishi Corp, where he held several progressive roles in business evaluation and operations planning, including as Mine General Manager. Mr. Simpson also has extensive experience in mine |

10

Table of Contents

| design, construction and project management from his previous work at Hatch Ltd. as a process engineer. Adriano Espeschit, the President of Potássio do Brasil Ltda., previously worked for Vale S.A. Iron Ore, Copper and Nickel and BHP Billiton in Australia, as well as Shell Canada where he was instrumental in discussions with the Fort McKay First Nation of Alberta regarding the development of the Lease 90 Project. Mr. Espeschit was part of the teams that developed the Sossego Copper Mine in Pará State with Vale S.A. and the Santa Rita Nickel Mine in Bahia State with Mirabela Nickel. |

Our Business Objectives and Growth Strategies

Our primary business objectives are to win a significant share of the Brazilian potash market and be the sustainable potash supplier-of-choice for Brazilian farmers. We intend to be a significant domestic source of potash fertilizer in Brazil to alleviate Brazils dependence on imported potash and farmer supply-chain risk, while supporting economic prosperity and agricultural sustainability in Brazil and food security globally. We plan to accomplish these business objectives by pursuing the following strategies:

| | Focus solely on providing our potash from the Autazes Project to Brazilian farmers. Brazil is the worlds second largest market, and one of the fastest growing markets, for potash consumption, but it imports approximately 98% of its potash needs, primarily from Canada, Russia and Belarus. Our potash production at the Autazes Project is expected to be entirely granular MOP for fertilizer applications that are currently being used in Brazil. Our planned mine and surface assets are expected to be optimally positioned in the Brazilian market to produce potash in close proximity to Brazilian farmers, enabling just-in-time delivery, with a shorter supply chain, as compared to overseas potash producers whose products must travel significant distances to reach Brazil, resulting in a significantly higher carbon footprint. We anticipate selling all of our produced potash in Brazil, and plan to target all of the key farming regions in Brazil, particularly the highest potash consuming states such as Mato Grosso. |

| | Establish and maintain a position as the lowest-cost provider of potash in Brazil. Given the location of the Autazes Project, we believe that we will be able to provide our processed potash at the lowest all-in delivered cost to Brazilian farmers. Our priority is to build and operate the Autazes Project mine with a strong focus on operational and commercial efficiency to ensure that we can achieve the low operating cost and emissions profile that will differentiate the Autazes Project and our Company from our competitors. Because our potash ore body is located in Brazil only five miles from the Madeira River, our primary mode of product transportation will be through relatively low-cost river barges followed by trucks, whereas our competitors typically have to transport their potash products between 8,000 to 12,000 miles in total by trains and ocean vessels to reach Brazil, followed by in-land trucking. Because of our location advantage, we believe that our estimated cost to mine, process and deliver our potash product to Brazilian farmers will be lower than the transportation cost alone for imported potash, which should provide us with a substantial and sustainable competitive advantage. Additionally, the core competencies of our management team include the development and operation of natural resource assets, particularly bulk commodities, and as such, we intend to take an asset-light approach to transportation and distribution by using competent third-party vendors to ensure our focus is squarely on realizing value from the Autazes Project. |

| | Establish strategic partnerships within the industry. To enable our supply chain to Brazilian farmers, we plan to pursue exclusive third-party marketing, logistics and offtake agreements with large-scale, vertically integrated Brazilian agri-business companies that have the scale and mid/downstream infrastructure to efficiently transport large quantities of our potash product from our planned port on the Madeira River to Brazilian farmers. We view this approach, which should provide us with access to tangible physical infrastructure and valuable local and regional agricultural knowledge, as both capital efficient and critical to establishing credibility and long-term customer relationships. |

11

Table of Contents

| | Nurture opportunity for sustainability leadership and innovation. An overarching component of our strategy is to establish our Company as an industry leader in sustainable potash production. We believe that our plan to connect the Autazes Project to Brazils national power grid, which has approximately 80% of its power generated by renewable sources, as well as the significantly shorter distances we expect to have to transport our potash product to Brazilian farmers, will enable us to establish a lower GHG emissions profile than can be found at other potash mines around the world. For example, based on our GHG Emissions Analysis, we believe that the Autazes Project will generate approximately 1.2 million tons (or approximately 80%) less Scope 2 GHG Emissions per year than the Scope 2 GHG Emissions generated by a potash producer located in Saskatchewan, Canada using similar conventional underground mining methods and exporting an amount of potash to Brazil equal to the amount of potash that we anticipate producing. For additional information regarding our GHG Emissions Analysis, see BusinessEnvironmental, Social and GovernanceClimate-related Risks and Opportunities (including GHG Emissions and Energy Management). |

| | Expand our production capabilities and growth opportunities. The Autazes Project is estimated to have a mine life of 23 years at a production rate of an average of approximately 2.4 million tons per year. We have explored less than 5% of the Amazonas potash basin that we believe to be mineralized based on drilling that was done during the 1970s and 1980s by Petrobras, Brazils state-owned petroleum company (which we refer to as Petrobras). Future exploration offers the opportunity to extend the life of the Autazes Project as well as increase potash production. |

Our Industry and Market Opportunity

Overview

Potash is the common name for the group of minerals containing potassium (K). Together with nitrogen and phosphorous, potash is one of the three primary nutrients essential for plant life, and we believe that it is an essential component to sustainably feed a growing world. The use of potash is necessary in order to grow more food per acre by enabling farmers to improve agricultural productivity and crop quality.

Agronomically, potash is responsible for promoting all critical metabolic functions in plants and improving plant resistance to biotic and abiotic stress. For example, potash supports photosynthesis, protein formation, and water regulation, increasing plant strength and improving resistance to factors that adversely affect crop yields such as disease, pests, heat, drought, and frost.

Plants pull nutrients from the soil as they grow. Fertilizer helps farmers to replenish the nutrients that are removed from the soil, and ensures the soil health necessary to generate strong crop yields in future seasons. This is particularly important in regions such as Brazil where farming intensity is high due to its favorable climate and the increasing number of large-scale and broadly mechanized farming operations.

The vast majority of potash is applied as MOP, which is the potash fertilizer product we plan to produce at the Autazes Project. MOP is the form of potash that is used on potassium-intensive row crops such as corn, soybean, rice, cotton and sugarcane, all of which are commonly grown in Brazil. According to potassium chloride market outlook information included in a database maintained by CRU (CRU Group, Potassium Chloride Market Outlook, November 2022) (which we refer to as the CRU November 2022 Potassium Chloride Market Outlook), global annual sales of potash were approximately 78 million tons per year in 2021, and the compound annual growth rate of the global potash market was approximately 2.38% from, 2003 to 2021, outpacing the growth of the other primary fertilizer nutrients. Brazil is the second largest potash market and one of the fastest growing markets in the world for potash consumption (CRU Group, CRUs Potassium Chloride Database, November 30, 2022). However, to properly contextualize the significance of Brazil, a general understanding of the global potash market supply and demand dynamics and the underlying drivers is beneficial.

12

Table of Contents

Potash Demand

As the worlds population grows, so too does global economic output, prosperity, and the demand for calorie-rich diets. In turn, these drive higher protein consumption, which relies on potash to increase food production. For example, according to the U.S. Department of Agriculture (which we refer to as the USDA) Economic Research Service, in the United States, approximately 46% of corn consumption is for animal feed, and approximately 43% is for the production of ethanol for blending with gasoline (USDA Economic Research Service, Feed Grains: Yearbook, September 12, 2024). In addition, according to a USDA Foreign Agricultural Service report, the majority of ethanol in Brazil is produced from sugar cane, another potash intensive crop (USDA Foreign Agricultural Service, Biofuels Annual Brazil, September 5, 2023). We believe that increasing meat consumption and improving methods of fertilizer application (particularly in developing economies where potash has been historically underapplied) will be key drivers of increased potash use. Furthermore, as many countries adopt decarbonization policies and biofuels become an increasingly important part of the energy transition, potash may play not only a critical role in feeding the world, but also in fueling it.

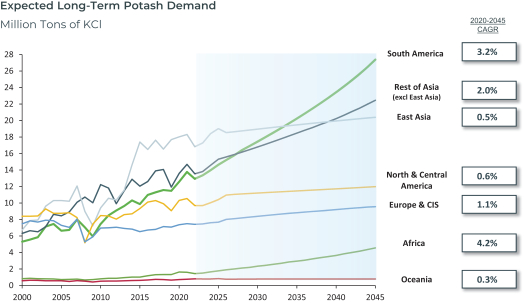

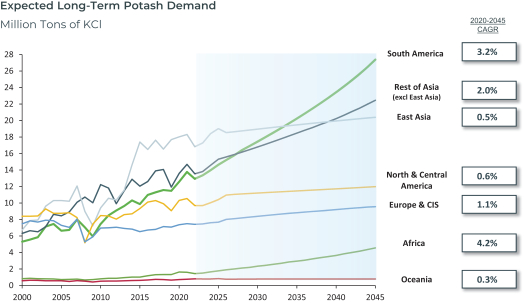

Source: CRU Group, Potassium Chloride Market Outlook, November 2022.

According to the CRU November 2022 Potassium Chloride Market Outlook, global annual sales of potash reached a record of approximately 78 million tons of MOP consumed in 2021, and the global potash market is expected to grow to approximately 85 million tons by 2026, driven largely by Brazil and Asia. China is presently the worlds largest consumer of potash, followed by Brazil, however, as referenced in the chart above, demand from South America is projected to eventually outpace demand from East Asia. Furthermore, Brazilian potash consumption is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2027, which is approximately 33% higher than the forecasted compound annual growth rate of 5.1% for global potash consumption during the same period.

13

Table of Contents

Potash Supply

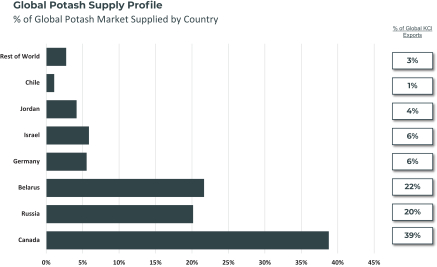

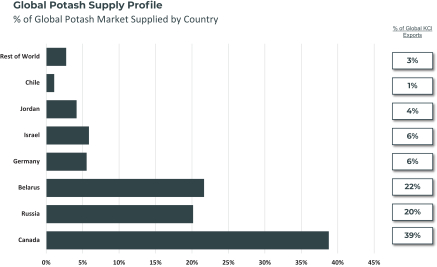

The global potash market is highly concentrated, comprised of just a few meaningful suppliers. The worlds largest potash reserves are located in only a few regions in the world. According to the CRU November 2022 Potassium Chloride Market Outlook, global potash exports in 2021 were approximately 62.9 million tons, with seven countries supplying over 97% of the global potash market. The countries that export the most potash are Canada, Russia, and Belarus.

Source: CRU Group, Potassium Chloride Market Outlook, November 2022.

The consolidated structure of the global potash market makes it susceptible to supply shocks, such as the disruptions caused by the COVID-19 pandemic, Belarussian sanctions, and Russias war in Ukraine, which have driven potash prices to record highs. The fastest growing regions in the world have few domestic sources of potash production, making them heavily reliant on imported potash and leaving them exposed to trade flow imbalances and supply chain disruptions. We expect the outlook for the global supply and demand of potash to be tight in the near future.

Market Opportunity: Brazil A Key Potash Market

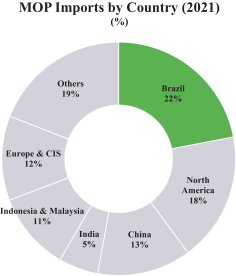

According to the Food and Agriculture Organization of the United Nations (which we refer to as FAO), Brazil was the largest net exporting country of agricultural goods in 2022 (FAO, FAO Corporate Statistical Database Import Value and Export Value data, 2022). And according to a release issued by the Brazilian Secretariat of Foreign Trade (SECEX) on January 16, 2024, Brazil exported approximately $166.6 billion of agricultural products in 2023, and Brazil ranks first in production for many of the worlds highest-demand and potash-intensive crops, such as soybean and sugarcane. In addition, Brazils agricultural land use has grown 3.3% from 2010 to 2021 (Our World in Data, Land Use Agricultural Land Use Chart, 2021). Consequently, Brazil is a key market for potash producers, since in order to increase the volume and value of crop yields, frequent and balanced replenishment of nutrients in the soil is needed. Potash is integral to Brazils economic success, since Brazil generates approximately 27% of its gross domestic product from the agricultural sector (USDA Foreign Agricultural Service, Brazilian Economic and Agricultural Overview, February 9, 2022). However, Brazil, like many other high growth regions such as China and Southeast Asia, is heavily reliant on imported potash and imports approximately 98% of its potash needs (CRU Group, CRUs Potassium Chloride Database, November 30, 2022). According to the CRU November 2022 Potassium Chloride Market Outlook, in 2021, Brazil imported

14

Table of Contents

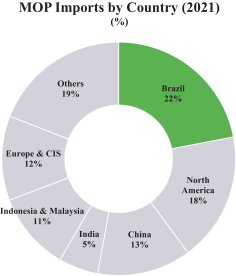

approximately 13.8 million tons of potash, representing approximately 22% of imported potash globally. We believe that Brazil is currently the largest global importer of potash, as illustrated by the chart below.

Source: CRU Group, Potassium Chloride Market Outlook, November 2022.

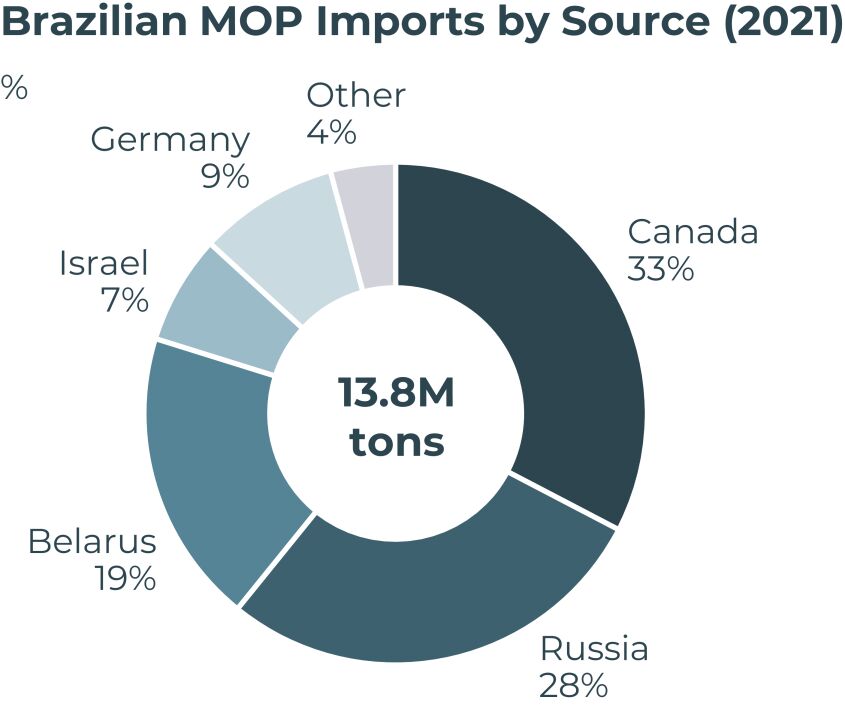

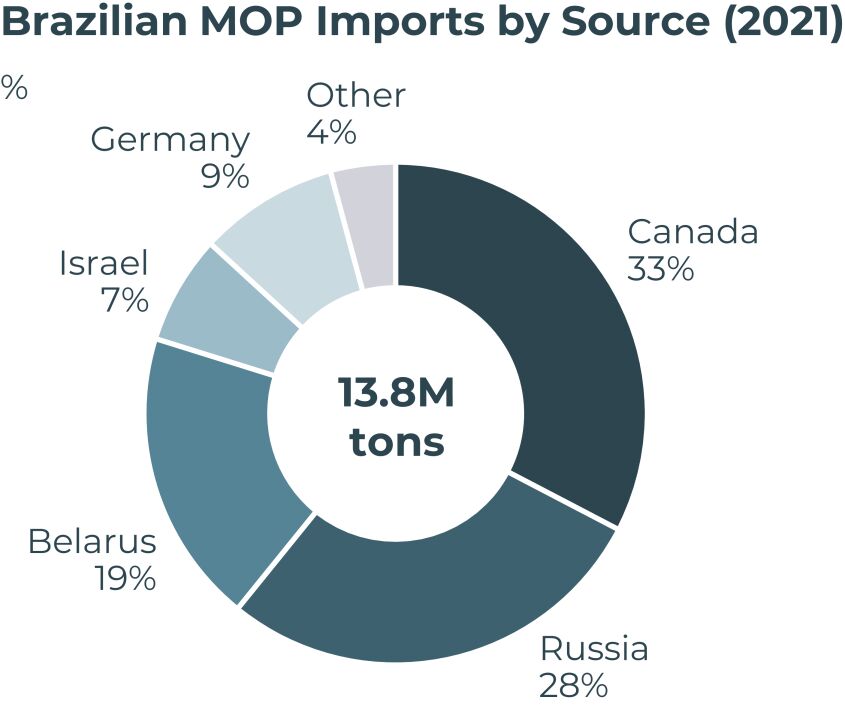

Additionally, as illustrated in the chart below, most of the potash that Brazil imports comes from Canada, Russia and Belarus, with approximately 47% of its imported potash in 2021 coming from currently sanctioned countries.

Source: CRU Group, Potassium Chloride Market Outlook, November 2022.

15

Table of Contents

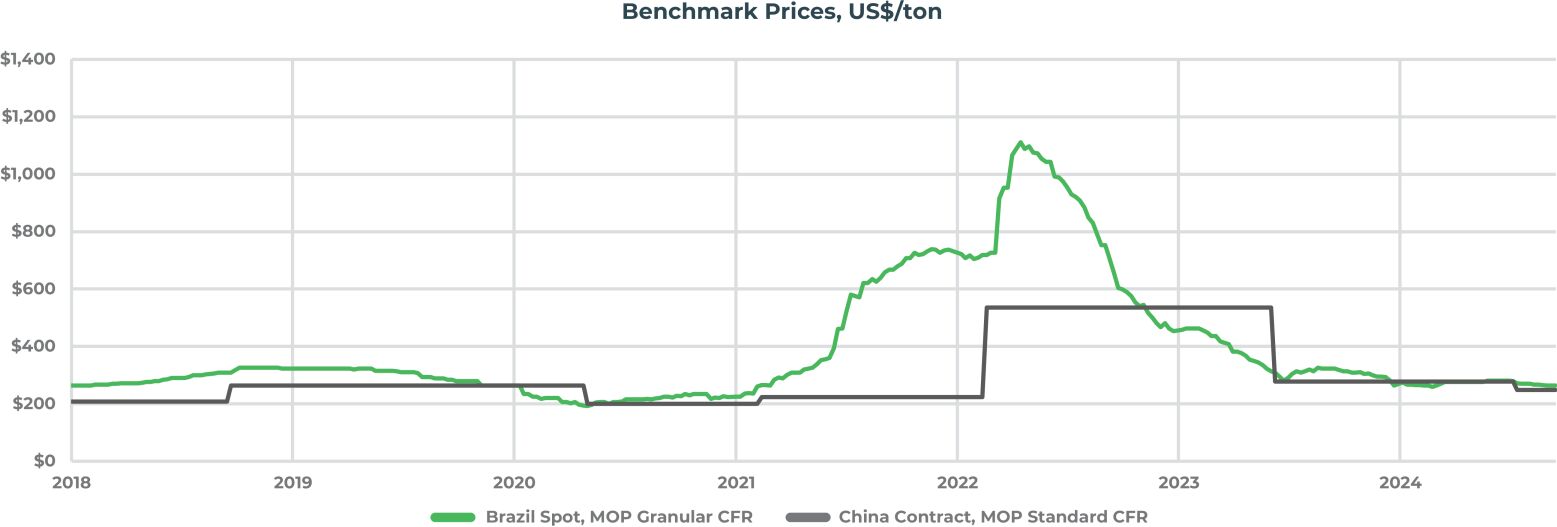

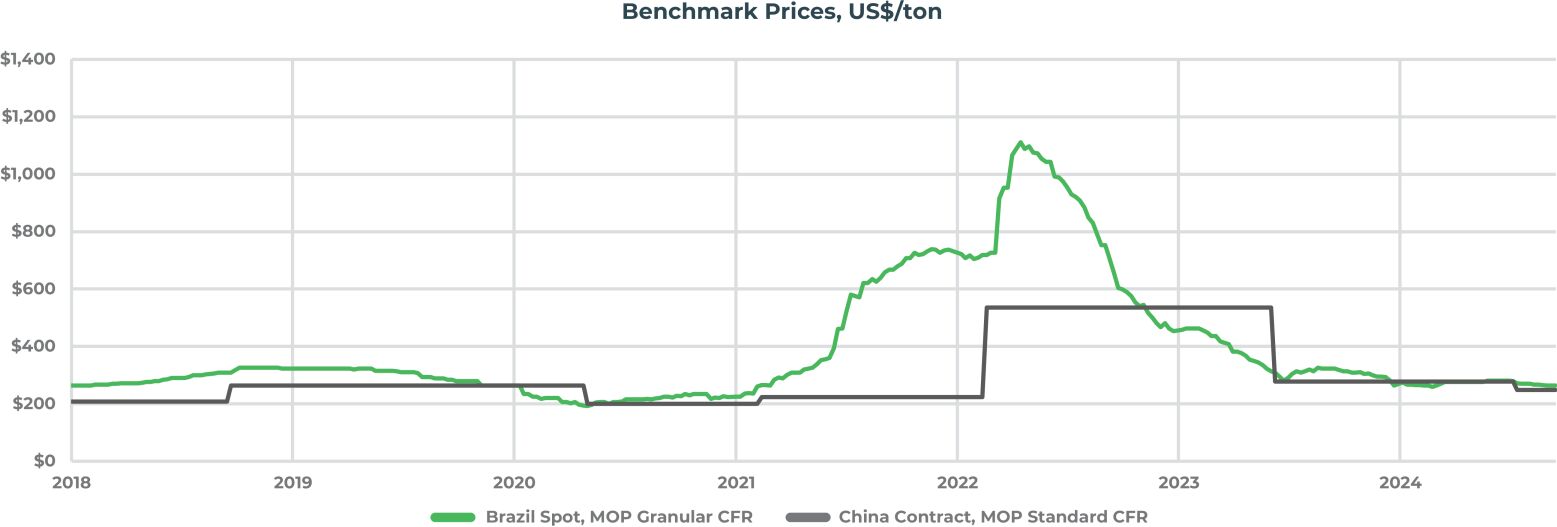

Due to relatively high logistics expenses and the highly fragmented number of buyers, customers in Brazil typically pay a higher price for MOP than most of the world. According to the CRU November 2022 Potassium Chloride Market Outlook, the preferred MOP product in the Brazilian market is granular potash with a target grade of 60.5% potassium oxide (K2O) (95% MOP), and it typically sells for a premium over standard (fine) MOP. The historic Cost and Freight (CFR) spot price for granular potash delivered to Brazil as compared to the CFR China contract price for standard potash is illustrated in the graph below:

Source: Green Markets (a Bloomberg company), Weekly Fertilizer Prices database, September 2024.

We plan to produce only granular 60.5% K2O MOP and sell all of our potash domestically in Brazil. We believe that we will have low transportation costs because the Autazes Project is located only five miles from the Madeira River where relatively lower cost barges can be used to transport our potash product a substantial portion of the way to Brazilian farmers. Because the Autazes Project will be located near a major river system, we believe that our cost to mine, process and deliver potash will be lower than the transportation cost alone for imported potash, which will provide a substantial and sustainable logistics cost advantage for our potash product. Based on our GHG Emissions Analysis, by connecting the Autazes Project to Brazils national electricity grid, which has approximately 80% of its power generated by renewable energy sources, and as a result of the substantially lower distances that we will have to transport our potash product to Brazilian farmers, we believe that our operations in Brazil will generate approximately 1.2 million tons less Scope 2 GHG Emissions per year than the Scope 2 GHG Emissions that would be generated by a potash producer located in Saskatchewan, Canada using similar conventional underground mining methods and exporting an amount of potash to Brazil equal to the amount of potash that we anticipate producing.

We believe that Brazils government recognizes that reliance on imported potash is not a tenable long-term solution. In 2022, Brazil launched a national fertilizer plan that aims to reduce its use of imported fertilizers from 85% of its current aggregate use to 45% by 2050, which implies obtaining approximately 6.6 million tons of potash from domestic sources. The Autazes Projects expected at-scale production of an average of approximately 2.4 million tons of MOP per year is expected to help Brazil achieve this objective. Additionally, the Autazes Project was designated as a project of National Importance by Brazils Federal Government and National Observatory in September 2020. The Federal Government of Brazil also admitted the Autazes Project into the Brazilian Investment Partnership Program in September 2021, which provides us with direct access to Brazils Attorney General to provide support on legal matters, and indicates that the Autazes Project should be a top priority for government officials in terms of their review of our permit and license applications. Furthermore, we believe that by purchasing the potash produced at the Autazes Project, Brazil will lower its total agricultural carbon footprint with a dramatically lower GHG emissions profile, as compared to purchasing potash from overseas producers. The Autazes Project is an asset intended to be by Brazil, for Brazil, with 100% of our produced potash expected to go to Brazilian farmers.

16

Table of Contents

Competition

The potash mining industry is subject to competitive factors, including, among others, the following:

| | Global macro-economic conditions and shifting dynamics, including trade tariffs and restrictions and increased price competition, or a significant change in agriculture production or consumption trends, could lead to a sustained environment of reduced demand for potash, and/or low commodity prices, which could favor competitors; |

| | Our products will be subject to price competition from both domestic and foreign potash producers, including foreign state-owned and government-subsidized entities, who will be less impacted by fluctuations in global potash prices; |

| | Potash is a global commodity with little or no product differentiation, and customers make their purchasing decisions principally on the basis of delivered price and, to a lesser extent, on customer service; |

| | Most of the potash mining companies with which we will be competing have a developed potash mining and production capacity, existing customer relationships, and greater financial resources and technical capabilities than we have at this point in time; |

| | Competitors and potential new entrants in the markets for potash have in recent years expanded capacity, begun construction of new capacity, or announced plans to expand capacity or build new facilities; and |

| | Some potash customers require access to credit to purchase potash, and a lack of available credit to customers could adversely affect demand for our potash as there may be an inability for such customers to replenish their inventories due to a lack of credit. Additionally, we currently do not intend to provide credit to customers in connection with their purchases of potash from us, however, certain of our competitors may do so, and customers may choose to purchase potash from such competitors for this reason. |