20-F: Annual and transition report of foreign private issuers [Sections 13 or 15(d)]

Published on March 28, 2025

Table of Contents

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 20-F

| ☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| ☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

For the transition period from to

Commission File No.: 001-42423

BRAZIL POTASH CORP.

(Exact name of registrant as specified in its charter)

Translation of registrants name into English: Not applicable

| Ontario, Canada | 198 Davenport Road Toronto, Ontario, Canada Tel: +1 (416) 309-2963 |

|

| (Jurisdiction of incorporation or organization) | (Address of principal executive offices) |

Matthew Simpson

Chief Executive Officer

+1 (416) 309-2963

info@brazilpotash.com

198 Davenport Road

Toronto, Ontario, Canada

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class to be registered |

Trading |

Name of each exchange on which each class is to be registered |

||

| Common shares, no par value | GRO | NYSE American |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Number of outstanding shares of each of the issuers classes of capital or common stock as of December 31, 2024: 38,403,737 ordinary shares.

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months. Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company.

| Large accelerated filer | ☐ | Accelerated filer | ☐ | Non-accelerated filer | ☐ | |||||

| Emerging Growth Company | ☒ | |||||||||

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its managements assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive based compensation received by any of the registrants executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing.

| U.S. GAAP ☐ | International Financial Reporting Standards as issued | Other ☐ | ||||||

| by the International Accounting Standards Board | ☒ |

If Other has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company. Yes ☐ No ☒

Auditor firm Id: 1930 Auditor name: MNP LLP Auditor location: Mississauga, Canada

Table of Contents

| Page | ||||||

| INTRODUCTION | 1 | |||||

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 5 | |||||

| PART I | 7 | |||||

| ITEM 1. | 7 | |||||

| ITEM 2. | 7 | |||||

| ITEM 3. | 7 | |||||

| ITEM 4. | 35 | |||||

| ITEM 4A. | 80 | |||||

| ITEM 5. | 80 | |||||

| ITEM 6. | 90 | |||||

| ITEM 7. | 117 | |||||

| ITEM 8. | 120 | |||||

| ITEM 9. | 121 | |||||

| ITEM 10. | 121 | |||||

| ITEM 11. | 132 | |||||

| ITEM 12. | 133 | |||||

| PART II | 135 | |||||

| ITEM 13. | 135 | |||||

| ITEM 14. | MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITY HOLDERS AND USE OF PROCEEDS |

135 | ||||

| ITEM 15. | 136 | |||||

| ITEM 16. | 137 | |||||

| ITEM 16A. | 137 | |||||

| ITEM 16B. | 137 | |||||

| ITEM 16C. | 137 | |||||

| ITEM 16D. | 138 | |||||

i

Table of Contents

| ITEM 16E. | PURCHASES OF EQUITY SECURITIES BY THE ISSUER AND AFFILIATED PURCHASERS |

138 | ||||

| ITEM 16F. | 138 | |||||

| ITEM 16G. | 138 | |||||

| ITEM 16H. | 139 | |||||

| ITEM 16I. | DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS |

139 | ||||

| ITEM 16J. | 140 | |||||

| ITEM 16K. | 140 | |||||

| PART III | 141 | |||||

| ITEM 17. | 141 | |||||

| ITEM 18. | 141 | |||||

| ITEM 19. | 141 | |||||

| SIGNATURES | 146 | |||||

ii

Table of Contents

As used in this Annual Report on Form 20-F (this Annual Report), unless the context otherwise requires or otherwise states, references to Brazil Potash, our Company, we, us, our, and similar references refer to Brazil Potash Corp., a corporation existing under the laws of the Province of Ontario, Canada, and its subsidiaries.

Our Companys functional currency and reporting currency is the U.S. dollar, the legal currency of the United States (USD, US$ or $). Our subsidiary in Brazil, Potássio do Brasil Ltda., determines its own functional currency based on its own circumstances. The functional currency of Potássio do Brasil Ltda. is the Brazilian real (R$). The functional and presentation currency of the Company in this Annual Report, is the U.S. dollar.

Financial Information

Our fiscal year ends on December 31 of each year as does our reporting year. Our audited consolidated financial statements were prepared in accordance with IFRS® Accounting Standards issued by the International Accounting Standards Board (IASB) and IFRIC® Interpretations of the IFRS Interpretations Committee, and audited in accordance with auditing standards generally accepted in the United States of America established by the Public Company Accounting Oversight Board (which we refer to as the PCAOB).

Rounding

Certain figures and some percentages included in this Annual Report have been subject to rounding adjustments. Accordingly, the totals included in certain tables contained in this Annual Report may not correspond to the arithmetic aggregation of the figures or percentages that precede them.

Reverse Stock Split and Share Consolidation

In July 2024, our board of directors and our stockholders approved a reverse stock split and share consolidation of our Common Shares in a range of up to five for one, which reverse stock split and share consolidation was effected on October 18, 2024 in a reverse stock split ratio of 4-for-1 (which we refer to as the Reverse Stock Split and Share Consolidation). The Reverse Stock Split and Share Consolidation combined each four outstanding Common Shares into one Common Share. Any fractional shares resulting from the Reverse Stock Split and Share Consolidation were rounded down to the nearest whole Common Share, and no cash or other consideration was paid in lieu of any fractional shares. All references to our Common Shares, common share purchase warrants, stock options, deferred share units, restricted stock units, share data, per share data, and related information in this Annual Report have been retroactively adjusted, where applicable, to reflect the Reverse Stock Split and Share Consolidation as if it had occurred at the beginning of the earliest period presented.

Mineral Disclosure

As used in this Annual Report, references to the Technical Report are to the Technical Report, Update of the Autazes Potash ProjectPre-Feasibility Study (dated October 14, 2022) with respect to our potash mining project located in the Amazon potash basin near the city of Autazes (which we refer to as the Autazes Project), which was prepared by ERCOSPLAN Ingenieurgesellschaft Geotechnik und Bergbau mbH (which we refer to as ERCOSPLAN) in accordance with the requirements of subpart 1300 of Regulation S-KDisclosure by Registrants Engaged in Mining Operations (which we refer to as the SEC Mining Modernization Rules) under the Securities Act of 1933, as amended (which we refer to as the Securities Act), which governs disclosure for registrants with material mining operations. Certain numeric values describing the Autazes Project disclosed herein have been converted from the metric system of measurement, which is used in the Technical Report, to the imperial system of measurement commonly used in the United States. A summary of the Technical Report is incorporated in this Annual Report by reference to Exhibit 96.1 to our registration statement on Form F-1 filed with the Securities and Exchange Commission on November 25, 2024.

1

Table of Contents

Additionally, on November 27, 2024, we filed a prospectus with the securities regulatory authorities in each of the provinces and territories of Canada, other than Quebec, in connection with the initial public offering of our Common Shares in Canada. As part of this filing process, ERCOSPLAN has also prepared the Technical Report, Update of the Autazes Potash ProjectPre-Feasibility Study (dated October 14, 2022) with respect to the Autazes Project, which was prepared in accordance with Canadian National Instrument 43-101Standards of Disclosure for Mineral Projects (which we refer to as NI 43-101), and was filed with Canadian securities regulatory authorities in accordance with NI 43-101. NI 43-101 is an instrument, developed by the Canadian Securities Administrators and administered by the provincial and territorial securities commissions in Canada, that governs how issuers in Canada publicly disclose scientific and technical information about their mineral projects.

Glossary of Technical Terms

The following are abbreviations and definitions of certain terms used in this Annual Report, which are commonly used in the potash mining industry:

| KCI | Potassium Chloride | |

| MOP | Muriate of Potash | |

| NI 43-101 | National Instrument 43-101Standards of Disclosure for Mineral Projects of the Canadian Securities Administrators | |

| ROM | Run-of-mine | |

| Scope 1 GHG Emissions | Direct greenhouse gas (GHG) emissions that occur from sources that are controlled or owned by an organization (e.g., emissions associated with fuel combustion in boilers, furnaces, vehicles) | |

| Scope 2 GHG Emissions | Indirect greenhouse gas (GHG) emissions associated with an organizations purchase of electricity, steam, heat, or cooling. Although Scope 2 GHG Emissions physically occur at the facility where they are generated, they are accounted for in the organizations GHG inventory because they are a result of the organizations energy use. | |

| Scope 3 GHG Emissions | Greenhouse gas (GHG) emissions that are the result of activities from assets not owned or controlled by the organization, but that the organization indirectly impacts in its value chain. Scope 3 GHG Emissions include all sources of GHG emissions not within the organizations Scope 1 GHG Emissions and Scope 2 GHG Emissions. Scope 3 GHG Emission sources include emissions both upstream and downstream of the organizations activities.

Scope 3 GHG Emissions, also referred to as value chain GHG emissions, often represent the majority of an organizations total GHG emissions. |

|

| SEC Mining Modernization Rules | Subpart 1300 of Regulation S-KDisclosure by Registrants Engaged in Mining Operations under the Securities Act of 1933, as amended. | |

| Technical Report | The Technical Report, Update of the Autazes Potash ProjectPre-Feasibility Study (dated October 14, 2022), prepared by ERCOSPLAN Ingenieurgesellschaft Geotechnik und Bergbau mbH in accordance with the requirements of the SEC Mining Modernization Rules.

A summary of the Technical Report is incorporated in this Annual Report by reference to Exhibit 96.1 to our Registration Statement on Form F-1 filed with the Securities and Exchange Commission on November 25, 2024. |

|

2

Table of Contents

Definitions under the SEC Mining Modernization Rules

In this Annual Report, we use the following defined terms from the SEC Mining Modernization Rules:

Feasibility Study means a comprehensive technical and economic study of the selected development option for a mineral project, which includes detailed assessments of all applicable Modifying Factors together with any other relevant operational factors, and detailed financial analysis that are necessary to demonstrate, at the time of reporting, that extraction is economically viable (which term, when used in the context of Mineral Reserve determination, means that the Qualified Person has determined, using a discounted cash flow analysis, or has otherwise analytically determined, that extraction of the Mineral Reserve is economically viable under reasonable investment and market assumptions). The results of the study may serve as the basis for a final decision by a proponent or financial institution to proceed with, or finance, the development of the project. A Feasibility Study is more comprehensive, and with a higher degree of accuracy, than a Pre-Feasibility Study. It must contain mining, infrastructure, and process designs completed with sufficient rigor to serve as the basis for an investment decision or to support project financing. The confidence level in the results of a Feasibility Study is higher than the confidence level in the results of a Pre-Feasibility Study. Terms such as full, final, comprehensive, bankable, or definitive feasibility study are equivalent to a Feasibility Study.

Indicated Mineral Resource means that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of adequate geological evidence and sampling. The level of geological certainty associated with an Indicated Mineral Resource is sufficient to allow a Qualified Person to apply Modifying Factors in sufficient detail to support mine planning and evaluation of the economic viability of the deposit. Because an Indicated Mineral Resource has a lower level of confidence than the level of confidence of a Measured Mineral Resource, an Indicated Mineral Resource may only be converted to a Probable Mineral Reserve.

Inferred Mineral Resource means that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of limited geological evidence and sampling. The level of geological uncertainty associated with an Inferred Mineral Resource is too high to apply relevant technical and economic factors likely to influence the prospects of economic extraction in a manner useful for evaluation of economic viability. Because an Inferred Mineral Resource has the lowest level of geological confidence of all mineral resources, which prevents the application of the Modifying Factors in a manner useful for evaluation of economic viability, an inferred mineral resource may not be considered when assessing the economic viability of a mining project, and may not be converted to a Mineral Reserve.

Initial Assessment means a preliminary technical and economic study of the economic potential of all or parts of the mineralization to support the disclosure of Mineral Resources. An Initial Assessment must be prepared by a Qualified Person and must include appropriate assessments of reasonably assumed technical and economic factors, together with any other relevant operational factors, that are necessary to demonstrate at the time of reporting that there are reasonable prospects for economic extraction. An Initial Assessment is required for disclosure of Mineral Resources, but cannot be used as the basis for disclosure of Mineral Reserves.

Measured Mineral Resource means that part of a Mineral Resource for which quantity and grade or quality are estimated on the basis of conclusive geological evidence and sampling. The level of geological certainty associated with a Measured Mineral Resource is sufficient to allow a Qualified Person to apply Modifying Factors in sufficient detail to support detailed mine planning and final evaluation of the economic viability of the deposit. Because a Measured Mineral Resource has a higher level of confidence than the level of confidence of either an Indicated Mineral Resource or an Inferred Mineral Resource, a Measured Mineral Resource may be converted to a Probable Mineral Reserve or to a Proven Mineral Reserve.

3

Table of Contents

Mineral Reserve means an estimate of tonnage and grade or quality of Indicated Mineral Resources and Measured Mineral Resources that, in the opinion of the Qualified Person, can be the basis of an economically viable project. More specifically, it is the economically mineable part of an Indicated Mineral Resource or Measured Mineral Resource, which includes diluting materials and allowances for losses that may occur when the material is mined or extracted.

Mineral Resource means a concentration or occurrence of a material economic interest in or on the Earths crust, in such form, grade or quality, and quantity, that there are reasonable prospects for economic extraction. A Mineral Resource is a reasonable estimate of mineralization, taking into account relevant factors such as cut-off grade, likely mining dimensions, location or continuity, that, with the assumed and justifiable technical and economic conditions, is likely to, in whole or in part, become economically extractable. It is not merely an inventory of all mineralization drilled or sampled.

Modifying Factors mean the factors that a Qualified Person must apply to Indicated Mineral Resources and Measured Mineral Resources and then evaluate in order to establish the economic viability of Mineral Reserves. A Qualified Person must apply and evaluate Modifying Factors to convert Indicated Mineral Resources or Measured Mineral Resources to Probable Mineral Reserves or Proven Mineral Reserves. Modifying Factors include, but are not restricted to: mining, processing, metallurgical, infrastructure, economic, marketing, legal, environmental, compliance, plans, negotiations, or agreements with local individuals or groups, and governmental factors. The number, type and specific characteristics of the Modifying Factors applied will necessarily be a function of and depend upon the mineral, mine, property, or project.

Pre-Feasibility Study means a comprehensive study of a range of options for the technical and economic viability of a mineral project that has advanced to a stage where a Qualified Person has determined (in the case of underground mining) a preferred mining method, or (in the case of surface mining) a pit configuration, and in all cases has determined an effective method of mineral processing. A Pre-Feasibility Study includes a financial analysis based on reasonable assumptions (which are based on appropriate testing) about the Modifying Factors, and the evaluation of any other relevant factors that are sufficient for a Qualified Person to determine if all or part of the Indicated Mineral Resources or Measured Mineral Resources may be converted to Probable Mineral Reserves or Proven Mineral Reserves at the time of reporting. The financial analysis must have the level of detail necessary to demonstrate, at the time of reporting, that extraction is economically viable. A Pre-Feasibility Study is less comprehensive and results in a lower confidence level than a Feasibility Study. A Pre-Feasibility Study is more comprehensive and results in a higher confidence level than an Initial Assessment.

Probable Mineral Reserve means the economically mineable part of an Indicated Mineral Resource, and, in some cases, a Measured Mineral Resource.

Proven Mineral Reserve means the economically mineable part of a Measured Mineral Resource. A Proven Mineral Resource can only result from conversion of a Measured Mineral Resource.

Qualified Person is an individual who is: (1) a mineral industry professional with at least five years of relevant experience in the type of mineralization and type of deposit under consideration and in the specific type of activity that person is undertaking on behalf of the registrant; and (2) an eligible member or licensee in good standing of a recognized professional organization at the time the technical report is prepared. For an organization to be a recognized professional organization, it must: (i) be either: (a) an organization recognized within the mining industry as a reputable professional association, or (b) a board authorized by U.S. federal or state or foreign statute to regulate professionals in the mining, geoscience or related field; (ii) admit eligible members primarily on the basis of their academic qualifications and experience; (iii) establish and require compliance with professional standards of competence and ethics; (iv) require or encourage continuing professional development; (v) have and apply disciplinary powers, including the power to suspend or expel a member regardless of where the member practices or resides; and (vi) provide a public list of members in good standing.

4

Table of Contents

Market and Industry Data

This Annual Report contains references to market data and industry forecasts and projections, which were obtained or derived from publicly available information, reports of governmental agencies, market research reports, and industry publications and surveys. These sources generally state that the information contained therein has been obtained from sources believed to be reliable, but that the accuracy and completeness of that information is not guaranteed. Although we believe such information to be accurate, we have not independently verified the data from these sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and additional uncertainties and risks regarding the other forward-looking statements in this Annual Report due to a variety of factors, including those described in the sections entitled Cautionary Note Regarding Forward-Looking Statements and Risk Factors and elsewhere in this Annual Report. These and other factors could cause results to differ materially from those expressed in the forecasts and projections. For the avoidance of doubt, nothing stated in this paragraph operates to relieve our Company from liability under applicable securities laws for any misrepresentation contained in this Annual Report.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

Various statements contained in this Annual Report, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are forward-looking statements. These forward-looking statements may include projections and estimates concerning our possible or assumed future results of operations, financial condition, business strategies and plans, market opportunity, competitive position, industry environment, and potential growth opportunities. In some cases, you can identify forward-looking statements by terms such as may, will, should, believe, expect, could, intend, plan, anticipate, estimate, continue, predict, project, potential, target, goal or other words that convey the uncertainty of future events or outcomes. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements in this Annual Report include, but are not limited to, statements with respect to:

| | our ability to achieve profitability in the future; |

| | our ability to obtain the necessary permits and licenses for the Autazes Project, and the timing and possible outcome of pending regulatory and permitting matters; |

| | proposed expenditures for exploration work, and general and administrative expenses; |

| | the development and construction of the Autazes Project; |

| | maintaining rights of access to, including successfully acquiring, leasing, purchasing and/or obtaining rights to occupy, the land for the development and operation of the Autazes Project; |

| | our capital requirements and need for additional financing, and our ability to raise additional capital; |

| | the estimated results of planned development, mining and production activities; |

| | the estimated results of our GHG Emissions Analysis (as defined herein); |

| | the supply and demand of potash; |

| | general economic and financial conditions; |

| | governmental regulation of mining operations and related matters; |

| | our prospects, strategies, and business objectives and milestones; and |

| | industry trends |

We have based these forward-looking statements on our current expectations and assumptions about future events. While our management considers these expectations and assumptions to be reasonable, because forward-looking statements relate to matters that have not yet occurred, they are inherently subject to significant business, competitive, economic, regulatory and other risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. These and other important factors, including, among others, those discussed in this Annual Report under the headings Item 3.D. Risk Factors, Item 5. Operating and Financial Review and ProspectsManagements Discussion and Analysis of Financial Condition and Results of Operations and Item 4.B. Business Overview, may cause our actual results, performance or achievements to differ materially from any future results, performance or achievements expressed or implied by the forward-looking statements in this Annual Report. Some of the factors that could cause actual results to differ materially from those expressed or implied by the forward-looking statements in this Annual Report include:

5

Table of Contents

| | the need for significant capital resources for the development and construction of the Autazes Project; |

| | the cost, timing, and results of our future development, mining and production activities; |

| | our ability to obtain the necessary permits and licenses for the Autazes Project, including that, once obtained, such permits and licenses may be terminated or not renewed by governmental authorities; |

| | our ability to maintain rights of access to, including to successfully acquire, lease, purchase and/or obtain rights to occupy, the land for the development and operation of the Autazes Project; |

| | issues with the urban areas, rural communities, and indigenous communities which surround our operations and the procedures required for their prior consultation; |

| | our ability to manage our development, growth and operating expenses; |

| | our lack of operating history on which to judge our business prospects and management; |

| | the possible material differences between our estimates of Mineral Reserves and the mineral quantities we will actually recover; |

| | lower than expected metallurgical assumptions; |

| | mining industry operational risk, such as operator errors, mechanical failures and other accidents, including risks relating to tailings impoundments; |

| | environmental, social and governance impacts and risks with respect to the development and operation of the Autazes Project; |

| | availability of capable labor near the mine of the Autazes Project; |

| | our ability to compete and succeed in competitive potash mining industry; |

| | our ability to raise capital and the availability of future financing; |

| | changes in Brazilian and international governmental and regulatory policies that apply to our operations; |

| | fluctuations in the currency exchange rate between the U.S. dollar or Canadian dollar and the Brazilian real; |

| | the risks and uncertainties relating to Brazilian and international economic and political conditions; |

| | adverse weather conditions, including those as a result of climate change; |

| | possible material differences between the estimates in our GHG Emissions Analysis and the GHG that we will actually produce in connection with our future operations at the Autazes Project; and |

| | potential delays in the different developmental and operational phases of the Autazes Project. |

Given the foregoing risks and uncertainties, you are cautioned not to place undue reliance on the forward-looking statements in this Annual Report. The forward-looking statements contained in this Annual Report are not guarantees of future performance and our actual results of operations and financial condition may differ materially from such forward-looking statements. In addition, even if our results of operations and financial condition are consistent with the forward-looking statements in this Annual Report, they may not be predictive of results or developments in future periods.

Any forward-looking statement that we make in this Annual Report speaks only as of the date of this Annual Report. Except as required by law, we do not undertake any obligation to update or revise, or to publicly announce any update or revision to, any of the forward-looking statements in this Annual Report, whether as a result of new information, future events or otherwise, after the date of this Annual Report.

6

Table of Contents

ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

| A. | Reserved. |

| B. | Capitalization and Indebtedness |

Not applicable.

| C. | Reasons for the Offer and Use of Proceeds |

Not applicable.

| D. | Risk Factors |

Summary Risk Factors

You should carefully consider the risks described below, together with all of the other information in this Annual Report. The risks and uncertainties described below are those significant risk factors, currently known and specific to us, that we believe are relevant to an investment in our securities. Additional risks and uncertainties not currently known to us or that we now deem immaterial may also harm us. If any of these risks actually occur, our business, financial condition, operating results and cash flows could be materially adversely affected. In such case, the trading price of our Common Shares would likely decline, and you may lose all or part of your investment. These risk factors include, but are not limited to:

| | We are an exploration and development company, and there is no guarantee that the Autazes Project will result in the commercial extraction of potash. |

| | The commencement of our mining operations for the Autazes Project is subject to various risks. |

| | Significant long-term changes in the agriculture space could adversely impact our business. |

| | Our ability to raise additional financing may be affected by global market conditions that we do not control and cannot predict. |

| | Shifting global dynamics may result in a prolonged agriculture downturn. |

| | We are subject to various levels of political, economic and other risks and uncertainties associated with operating in Brazil. |

| | We do not currently have an operating mine, and the development of the Autazes Project into an active mining operation is highly speculative in nature, may be unsuccessful, and may never result in the development of an operating mine. |

| | The failure to acquire, lease, purchase, or obtain rights to occupy all of the land intended for the operation of the Autazes Project could adversely impact our development of the Autazes Project. |

| | Governmental regulations, including mining and environmental laws, regulations and other legislation, may increase our costs of doing business, restrict our operations, or result in the imposition of fines, the revocation of permits, or the shutdown of our facilities. |

| | Our business is highly dependent on the market demand for and prices of the potash we plan to mine and produce, which are both cyclical and volatile. |

| | Our estimates of potash ore resources and reserves may be materially different from the quantities of potash we actually recover, and market price fluctuations and changes in operating and capital costs may render certain potash ore reserves uneconomical to mine. |

| | Mining operations involve inherent risks and uncertainties, some of which are not insurable. |

| | The potash mining industry is highly competitive. |

| | Our long-term success will depend ultimately on our ability to achieve and maintain profitability and to develop positive cash flow from our mining activities. |

| | We have no history of mining operations on which to judge our business prospects and management, and may never achieve active potash production. |

| | We have a history of negative operating cash flows and net losses, and we have never achieved and may never achieve or sustain profitability. |

7

Table of Contents

| | Our financial situation creates substantial doubt whether we will continue as a going concern. |

| | We will need but may be unable to obtain additional funding on satisfactory terms, which could dilute our shareholders or impose burdensome financial restrictions on our business. |

| | We may face potential opposition to the Autazes Project, which could increase our operating costs or result in substantial delays or a shutdown of the Autazes Project. |

| | Our development depends on our management members and other key personnel and skilled labor, and our ability to attract, hire, train and retain them. |

| | Conflicts of interest may exist between us and certain of our directors and executives. |

| | Our executives, directors, major shareholders, and their respective affiliates exercise significant control over us, which may limit your ability to influence corporate matters and could delay or prevent a change in corporate control. |

| | As a foreign private issuer, we will have different disclosure and reporting requirements than U.S. domestic issuers, which could limit the information publicly available to our shareholders. |

| | Because we are a corporation incorporated in Ontario, Canada, and all of our directors and executives, as well as the experts named in this Annual Report, reside outside of the United States, it may be difficult for investors in the United States to enforce civil liabilities against our Company, our directors, our executives, or such experts. Similarly, it may be difficult for Canadian investors to enforce civil liabilities against our directors, our executives, or such experts residing outside of Canada. |

| | We believe that we will likely be classified as a passive foreign investment company for U.S. federal income tax purposes for the current taxable year, which could result in material adverse U.S. federal income tax consequences if you are a U.S. Holder. |

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

We are an emerging growth company, as defined in Section 2(a) of the Securities Act, as modified by the Jumpstart Our Business Startups Act of 2012 (which we refer to as the JOBS Act). As such, we are eligible to take advantage of specified reduced reporting and other requirements that are otherwise generally applicable to reporting companies that make filings with the U.S. Securities and Exchange Commission (which we refer to as the SEC). For so long as we remain an emerging growth company, we will not be required to, among other things:

| | present more than three years of audited financial statements and three years of related managements discussion and analysis of financial condition and results of operations disclosure in a registration statement of which a prospectus forms a part; |

| | have an auditor report on our internal control over financial reporting pursuant to Section 404(b) of the Sarbanes-Oxley Act of 2002 (which we refer to as the Sarbanes-Oxley Act); |

| | comply with any requirement that may be adopted by the Public Company Accounting Oversight Board regarding mandatory audit firm rotation or a supplement to the auditors report to provide additional information about the audit and our financial statements (i.e., an auditor discussion and analysis); |

| | disclose certain executive compensation related items; and |

| | seek shareholder non-binding advisory votes on certain executive compensation matters and golden parachute arrangements, to the extent applicable to us as a foreign private issuer. |

In addition, under the JOBS Act, emerging growth companies can delay adopting new or revised accounting standards until such time as those standards apply to private companies. Given that we currently report, and expect to continue to report, under IFRS as issued by the IASB, we will not be able to avail ourselves of this extended transition period, and, as a result, we will adopt new or revised accounting standards on the relevant dates on which adoption of such accounting standards is required by the IASB.

We will remain an emerging growth company until the earlier of (i) the last day of the fiscal year following the fifth anniversary of the completion of our initial public offering, (ii) the last day of the first fiscal year during which we have total annual gross revenue of at least $1.235 billion, (iii) the date on which we are deemed to be a large accelerated filer under the Securities Exchange Act of 1934, as amended (which we refer to as the Exchange Act), which means the market value of our Common Shares that are held by non-affiliates exceeds $700.0 million as of the last business day of our most recently completed second fiscal quarter, or (iv) the date on which we have issued more than $1.0 billion in non-convertible debt securities during the prior three-year period.

8

Table of Contents

Additionally, we are a foreign private issuer under the Exchange Act and will report in accordance with the rules and regulations applicable to a foreign private issuer. As a foreign private issuer, we take advantage of certain provisions under the rules that allow us to follow the laws of the Province of Ontario for certain corporate governance matters. Even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

| | the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events; |

| | the rules under the Exchange Act requiring U.S. domestic public companies to issue financial statements prepared under U.S. GAAP; and |

| | Regulation Fair Disclosure (also known as Regulation FD), which regulates selective disclosures of material information by issuers. |

As a foreign private issuer, we will have four months after the end of each fiscal year to file our annual report on Form 20-F with the SEC. In addition, our executive officers, directors, and principal shareholders will be exempt from the requirements to report transactions in our equity securities and from the short-swing profit liability provisions contained in Section 16 of the Exchange Act.

Foreign private issuers, like emerging growth companies, are exempt from certain more stringent executive compensation disclosure rules. As such, even when we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will continue to be exempt from the more stringent compensation disclosures required of public companies that are not a foreign private issuer.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We are required to determine our status as a foreign private issuer on an annual basis at the end of our second fiscal quarter. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies:

(i) the majority of our executive officers or directors are U.S. citizens or residents;

(ii) more than 50% of our assets are located in the United States; or

(iii) our business is administered principally in the United States.

In this Annual Report, we have taken advantage of certain of the reduced reporting requirements as a result of being an emerging growth company and a foreign private issuer. Accordingly, the information that we provide in this Annual Report may be different than the information you may see in other public companies annual reports in which you hold equity interests. If some investors find our securities less attractive as a result, there may be a less active trading market for our securities and the prices of our securities may be more volatile.

Risks Related to our Business

We are an exploration and development company, and there is no guarantee that the Autazes Project will result in the commercial extraction of potash.

The Autazes project has not yet commenced commercial extraction, processing, sale, or distribution of potash ore. Accordingly, we do not expect to realize profits in the short term, and we also cannot assure you that we will realize profits in the medium to long term or ever. Any profitability in the future from our business will be dependent upon further development of the Autazes Project, which is subject to various risks.

9

Table of Contents

The exploration and development of potash ore involves a high degree of financial risk over a significant period of time. There is no guarantee that current development plans will result in profitable commercial mining operations. The profitability of our operations will be, in part, related to the cost and success of our development plans, which may be affected by several factors. Additional expenditures are required to construct, complete and install mining and processing facilities for the Autazes Project.

Additionally, projects like ours have no operating history upon which to base estimates of future operating costs and capital requirements. Operating results for future periods are subject to numerous uncertainties, and we cannot assure you that we will ever be able to develop and produce potash from a commercially viable mine on the Autazes Property, or achieve or sustain profitability. Items such as future estimates of reserves or operating costs will to a large extent be based upon the interpretation of geologic data, obtained from a limited number of drill holes and other sampling techniques, as well as the Technical Report. Our prospects must be considered in light of the risks encountered by mining companies in the early stage of project development. Actual operating costs and economic returns from our mining operations once they have commenced may materially differ from our estimated operating costs and economic returns, and accordingly, our results of operations, cash flows, and financial condition may be materially and adversely affected.

The commencement of our mining operations for the Autazes Project is subject to various risks.

Our level of profitability, if any, in future years will depend to a great degree on prices of potash set by global markets and whether the Autazes Project can be brought into production. Whether we can commence our mining operations depends on a number of factors, including, but not limited to:

| | the willingness of lenders and investors to provide project financing; |

| | the particular attributes of the potash deposit on the Autazes Property, such as its grade; |

| | prices for potash; |

| | mining, processing and transportation costs; |

| | labor costs; and |

| | governmental regulations, including, without limitation, regulations relating to prices, taxes, land use, protection of local indigenous communities, importing and exporting materials, foreign exchange, environmental protection, employment, worker safety, transportation, and reclamation and closure obligations. |

The exact effect of these factors cannot be accurately predicted, but any of these factors on their own or a combination of these factors may materially and adversely affect our results of operations, financial condition, and prospects.

Significant long-term changes in the agriculture space could adversely impact our business.

The agricultural landscape is evolving at an increasingly fast pace as a result of various factors, including farm and industry consolidation, agricultural productivity and development, and climate change. Farm consolidation in developed markets has been ongoing for decades and is expected to continue as farmer demographics shift and advancements in innovative technology and equipment enable farmers to manage larger operations to create economies of scale in a lower-margin, more capital-intensive environment, which will also provide such consolidated agricultural entities with more bargaining power in connection with their purchases of potash. The advancement and adoption of technology and digital innovations in agriculture and across the value chain have increased and are expected to further accelerate as farmer demographics shift and pressures from consumer preference and governments evolve. The development of seeds that require less crop nutrients, development of full or partial substitutes for potash, or developments in the application of crop nutrients such as improved nutrient use or efficiency through use of precision agriculture could also emerge, all of which have the potential to adversely affect the demand for potash and our results of operations.

10

Table of Contents

Additionally, increased consolidation in the crop nutrient industry has resulted in greater resources dedicated to expansion and research and development opportunities, leading to increased competition in advanced product offerings and innovative technologies. Some of our competitors have greater total resources or are state-supported, which make them less vulnerable to industry downturns and better positioned to pursue new expansion and development opportunities.

These factors as well as others (such as changes in dietary habits) could adversely affect long-term demand for our products and services, and materially and adversely affect our results of operations, financial condition, and prospects.

Our ability to raise additional financing may be affected by global market conditions that we do not control and cannot predict.

In order for us to complete the development and construction of the Autazes Project and commence commercial extraction of potash, we will need to raise additional financing in the future, which may include additional equity and/or debt financings. Recent global financial conditions, however, have been characterized by increased volatility, and access to public financing, particularly for exploration and development companies, has been negatively impacted. These conditions may affect our ability to obtain equity or debt financing in the future on terms favorable to us or at all. If such conditions continue, we may not be able to complete the development and construction of the Autazes Project, and our business and prospects could be materially and adversely impacted.

Shifting global dynamics may result in a prolonged agriculture downturn.

Global macro-economic conditions and shifting dynamics, including trade tariffs and restrictions and increased price competition, or a significant change in agriculture production or consumption trends, could lead to a sustained environment of reduced demand for potash, and/or low commodity prices. The potash market is subject to intense price competition from both domestic and foreign sources, including state-owned and government-subsidized entities which are better able to absorb these shifting dynamics. Potash is a global commodity with little or no product differentiation, and customers make their purchasing decisions principally on the basis of delivered price and, to a lesser extent, on customer service. Supply is affected by available capacity and operating rates, raw material costs and availability, government policies, and global trade. Periods of high-demand, high-capacity utilization, and increasing operating margins tend to result in investment in production capacity, which may cause supply to exceed demand and capacity utilization and realized selling prices for potash to decline, resulting in possible reduced profit margins. Competitors and potential new entrants in the market for potash have in recent years expanded capacity, begun construction of new capacity, or announced plans to expand capacity or build new facilities. The extent to which current global or local economic and financial conditions, changes in such conditions, or other factors may cause delays or cancellation of some of these ongoing or planned projects, or result in the acceleration of existing or new projects, is uncertain. Future growth in demand for our products may not be sufficient to absorb excess industry capacity.

We are impacted by global market and economic conditions that could adversely affect demand for crop nutrients, or increase prices for, or decrease availability of, raw materials and energy necessary to produce potash. This includes the relative value of the U.S. dollar and its impact on the importation of fertilizers, foreign agricultural policies, the existence of, or changes in, import or foreign currency exchange barriers in certain foreign markets, and other regulatory policies of foreign governments, trade wars and measures taken by governments which may be deemed protectionist, as well as the laws and policies affecting foreign trade and investment. Furthermore, some customers require access to credit to purchase potash, and a lack of available credit to customers in one or more countries, due to this deterioration, could adversely affect demand for crop nutrients as there may be an inability to replenish inventories in such conditions. We currently do not intend to provide credit to customers in connection with their purchases of potash from us, however, certain of our competitors may do so, and customers may choose to purchase potash from such competitors for this reason.

11

Table of Contents

We are subject to various levels of political, economic and other risks and uncertainties associated with operating in Brazil.

The Autazes Project and the Autazes Property are located in Brazil, and, as a result, our operations are exposed to various levels of political, economic and other risks and uncertainties associated with operating in a foreign jurisdiction. These risks and uncertainties include, but are not limited to:

| | fluctuations in currency exchange rates, restrictions on foreign exchange, currency controls, and currency remittance; |

| | price controls; |

| | import or export controls; |

| | high rates of inflation; |

| | labor unrest; |

| | community relations; |

| | renegotiation or nullification of existing concessions, licenses, permits, applications and contracts; |

| | expropriation and nationalization; |

| | illegal mining; |

| | tax disputes and changes in tax policies; |

| | governmental regulations that may require the awarding of contracts of local contractors or require foreign contractors to employ citizens of, or purchase supplies from, a particular jurisdiction; |

| | changing political conditions, including corruption; |

| | terrorism and hostage taking; and |

| | risks of war or civil unrest, including military repression. |

Changes, if any, in mining or investment policies or shifts in political attitudes in Brazil may adversely affect our operations. We may become subject to local political unrest or poor community relations that could have a debilitating impact on our operations and could result in damage to site infrastructure and injury to personnel. Additionally, our planned operations may be affected to varying degrees by government regulations with respect to, among other things, restrictions on production, price controls, export controls, currency remittance, income taxes, expropriation of property, foreign investment, maintenance of claims, environmental legislation, land use, land claims of local people, water use, and mine safety. Any failure by us to comply with applicable laws, regulations and local practices may result in loss, reduction or expropriation of entitlements, and enforcement actions, including corrective measures requiring capital expenditures, installing of additional equipment, increasing security at the site, or other remedial actions. Parties engaged in mining operations may be required to compensate those suffering loss or damage as a result of mining activities, and may have administrative, civil or criminal fines or penalties imposed for violations of applicable laws or regulations, which may materially and adversely affect our results of operations, financial condition, and prospects.

Furthermore, on October 31, 2022, Luiz Inácio Lula da Silva (President Lula) was elected as the next president of Brazil with a four-year term commencing in January 2023. As part of President Lulas electoral campaign, he made public statements regarding being committed to stopping illegal mining, but was also supportive of legal, permitted mining in Brazil. Nonetheless, it is difficult to predict how President Lulas new term will affect Brazils mining industry and regulatory regime at this time. In the event that President Lula determines to pass more stringent regulations on Brazils mining industry, our business and prospects could be materially and adversely impacted. Future elections and potential change of governments, both at the federal and state level, could result in new administrations with different views towards the mining industry, which could adversely affect our business and prospects.

The occurrence of any of these various factors and uncertainties cannot be accurately predicted and could have an adverse effect on our operations and profitability.

12

Table of Contents

Our business, financial condition and results of operations may be adversely affected by inflation.

Brazil has historically experienced high rates of inflation. Inflation, as well as government efforts to combat inflation, has had significant negative effects on the Brazilian economy. The Brazilian federal governments measures to control inflation have often included maintaining a tight monetary policy with high interest rates, thereby restricting the availability of credit and reducing economic growth. Inflation, actions that may be implemented to combat inflation, and public speculation about any possible additional actions may also contribute to economic uncertainty in Brazil and weaken investor confidence in Brazil, which may adversely impact our ability to access the capital markets. Conversely, more lenient government and Brazilian Central Bank policies and interest rate decreases may trigger increases in inflation and, consequently, growth volatility and the need for sudden and significant interest rate increases, which could materially and adversely affect our business.

As a result, Brazil may continue to experience high levels of inflation in the future, which may negatively impact domestic demand for our products, result in higher labor, transportation, machinery and raw materials costs, and consequently cause our development, construction, and operating costs for the Autazes Project to be substantially higher than initially estimated. Inflationary pressures may also lead to further government intervention in the economy, including the introduction of government policies that may materially and adversely affect the overall performance of the Brazilian economy, which in turn may limit our ability to obtain additional financing at acceptable interest rates and terms, if at all, and materially and adversely affect our business. In addition, we may not be able to adjust the prices we charge to our customers to offset the effects of inflation on our cost structure.

Our results of operations and financial condition may be materially and adversely affected by currency exchange rate fluctuations.

We are subject to risks related to currency exchange rate fluctuations. Our reporting currency is the dollar of the United States of America, which is exposed to fluctuations against other currencies. Our primary operations are located in Brazil where expenditures and obligations are incurred in the Brazilian real. As such, our results of operations are subject to foreign currency fluctuation risks and such fluctuations may adversely affect our financial position and operating results. We have not undertaken any actions to mitigate transactional volatility in the United States dollar to the Brazilian real at this time. While we may enter into foreign currency forward contracts in the future in order to match or partially offset existing currency exposures, there is no guarantee that such contracts would fully mitigate our currency exposure.

The nature of our business includes risks related to litigation, regulatory and administrative proceedings, including the costs of such proceedings and the potential for damage awards that could materially and adversely affect our business and financial performance in the event of an unfavorable ruling.

The nature of our business exposes us to various risks related to litigation, including regulatory and administrative proceedings, governmental investigations, tax matters, environmental matters, health and safety matters, labor matters, civil liability claims, tort claims, and contract disputes, among others. Litigation and other proceedings can be inherently costly and unpredictable, making it difficult to accurately estimate the outcome of existing or future litigation. In addition, responding to such claims and defending such actions may be distracting to our management team. Although we establish provisions as we deem necessary in accordance with IFRS, the amount of provisions that we record could vary significantly from any amounts we actually pay, due to the inherent uncertainties and shortcomings in the estimation process. Future litigation costs, settlements or judgments could materially and adversely affect our results of operations and financial condition. Legal proceedings could have a material adverse effect on our ability to conduct our business and on our results of operations and financial condition, through increased litigation costs, settlements or judgements, diversion of resources, distraction of our management team, reputational damage, or otherwise.

Unpredictable events could delay our operations, affect our ability to raise capital, increase our costs and expenses, and seriously harm our future results of operations and financial condition.

Our operations could be subject to unpredictable events, such as extreme weather conditions, acts of God and epidemics, and other natural or manmade disasters, or business interruptions, for which we may not be adequately prepared or self-insured.

We do not carry insurance for all categories of risk that our business may encounter. The occurrence of any such business disruptions could increase our costs and expenses and seriously harm our operations and financial condition. The ultimate impact on us and the potash mining sector of any such business disruptions is unknown, but our operations and financial condition could suffer in the event of any of these types of unpredictable events. Furthermore, any significant uninsured liability may require us to pay substantial amounts, which would adversely affect our business, results of operations, cash flows, and financial condition.

13

Table of Contents

Risks Related to Mining

We do not currently have an operating mine, and the development of the Autazes Project into an active mining operation is highly speculative in nature, may be unsuccessful, and may never result in the development of an operating mine.

The Autazes project has not yet commenced commercial extraction, processing, sale, or distribution of potash ore. Mine development is highly speculative in nature, involves many risks and uncertainties, and is frequently unsuccessful. First, mineral exploration must be performed to demonstrate the dimensions, position and mineral characteristics of mineral deposits, estimate Mineral Resources, assess amenability of the deposit to mining and processing scenarios, and estimate potential deposit size. Once mineralization is discovered, it may take a number of years from the initial exploration phases before mineral development and production is possible, during which time the potential feasibility of the project may change adversely. Even if mineralization is discovered, that mineralization may not be economic to mine. A significant number of years, studies, and substantial expenditures are required to establish economic mineralization in the form of Proven Mineral Reserves and Probable Mineral Reserves, to determine processes to extract the metals, to obtain the rights to the land and the resources (including capital) required to develop the mining operation, and to construct mining and processing facilities.

Additionally, whether developing an operating mine at the Autazes Project is economically feasible will depend upon numerous additional factors, most of which are beyond our control, including the availability and cost of required development capital, movement in the price of potash, as well as obtaining all necessary consents, permits and approvals for the development of the mine. The economic feasibility of development projects is based upon many factors, including the accuracy of Mineral Resource and Mineral Reserve estimates; metallurgical recoveries; capital and operating costs; government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting, and environmental protection; and commodity prices, which are highly volatile. Development projects are also subject to the successful initial completion and any required subsequent updating of the Technical Report. Any of these factors and uncertainties may result in us being unable to successfully develop a commercially viable operating mine.

The failure to acquire, lease, purchase, or obtain rights to occupy all of the land intended for the operation of the Autazes Project could adversely impact our development of the Autazes Project.

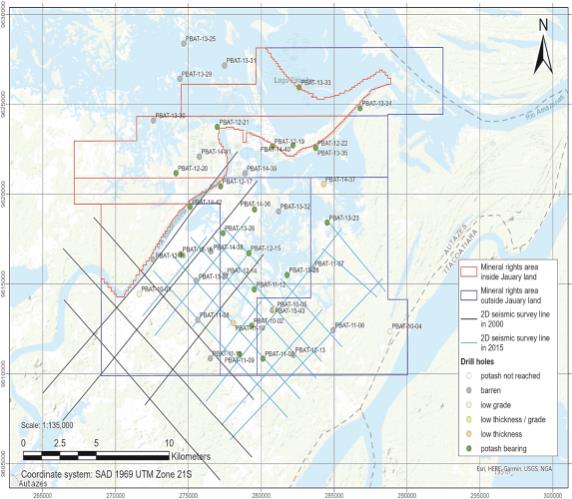

Under our current development plan for the Autazes Project, we intend to own, lease, have rights of access to or have rights to occupy, through Potássio do Brasil Ltda., 39 rural properties on which the facilities and infrastructure for the Autazes Project will be located. We currently have rights of access to 24 rural properties consisting of a total area of approximately 5.4 square miles, which include the land on which our proposed mine shafts, processing plant, and port for the Autazes Project will be constructed. We intend to conduct administrative land regularization proceedings with applicable Brazilian governmental agencies (such as the Brazilian National Institute of Rural Settlement and Agrarian Reform, the Brazilian Ministry of Industry and Trade, and other agencies), the purpose of which is to acquire ownership of these 24 properties. As of the date of this Annual Report, we have not yet commenced any land regularization proceedings, which will generally be conducted in accordance with Opinion CGU/AGU (as more fully described in Item 4.D. Property, Plant and EquipmentDescription of the Autazes Project and the Autazes PropertyOwnership of Land). There is no guarantee that such applicable Brazilian governmental agencies will issue administrative decisions approving our acquisition and ownership of such properties on a timely basis or at all, as our acquisition of properties in Brazil will depend on us following the applicable legal procedures and meeting the required legal standards, which will be assessed by such applicable Brazilian governmental agencies within an uncertain timeline. See also Our mining operations may be impaired due to restrictions on the acquisition or lease of rural properties by foreign investors or by Brazilian entities under foreign control or with the majority of its capital stock held by foreign persons below and Item 4.B. Business OverviewForeign Investment Restrictions and ControlForeign Investment Restrictions.

14

Table of Contents

Additionally, in March, April and May 2024, we entered into agreements to lease, for a term of six years, the remaining 15 rural properties consisting of a total area of approximately 4.2 square miles, which primarily will be used for the sites of our dry stacked tailings piles (see also Item 4.B. Business Overview Foreign Investment Restrictions and ControlForeign Investment Restrictions). Each of these lease agreements also provides us with a right of first refusal to purchase the applicable leased property in the event of a sale of such property. However, there can be no assurance that we will exercise such right of first refusal options, or otherwise acquire the remaining land at a price or on terms favorable to us, or at all. To the extent we are unable to exercise the right of first refusal options for, or otherwise do not purchase, the 15 remaining properties, the Brazilian National Mining Agency is allowed to grant mining easements (servidões minerárias) in properties of third parties in relation to a given mining title, provided that such mining easement is necessary for the proper exploration and exploitation of the mineral deposit. After the granting of an easement by the Brazilian National Mining Agency, through the issuance of a Public Utility Statement, the holder of the mining title to which the Public Utility Statement refers must pay an indemnification amount to the owner of the servient property before entering such property. If such indemnification amount cannot be agreed upon between the holder of the mining title and the property owner, it will be determined by a court. However, the process to obtain such mining easements can be costly and time consuming. There can be no guarantee that, despite having the right to obtain such mining easements in order to carry on our planned mining activities, we will be able to do so in a cost-and time-efficient manner. Even if any mining easements are granted to us by the Brazilian National Mining Agency, we still need to negotiate a satisfactory arrangement and indemnification amount with the owner of the servient property. Furthermore, in circumstances where no agreement can be reached, we may need to rely on a court to determine such indemnification amount, the outcome of which cannot be predicted with any certainty. Our inability to secure regular access to areas where we currently plan to construct certain of our facilities and infrastructure, such as our two planned tailings piles, could materially and adversely affect our timing, cost, or overall ability to develop and construct the Autazes Project.

If we fail to acquire the 24 properties to which we currently have rights of access, or renew the lease agreements for, or acquire, the remaining 15 properties that we currently lease, we may be forced to find replacement sites for our facilities at the Autazes Project, which sites may be less convenient or difficult to access, which in turn would increase the time and/or costs to develop and construct the Autazes Project, decrease productivity at the Autazes Project once operational, and adversely affect our business, results of operations, and financial condition.

Our mining operations may be impaired due to restrictions on the acquisition or lease of rural properties by foreign investors or by Brazilian entities under foreign control or with the majority of its capital stock held by foreign persons.

Pursuant to applicable Brazilian laws and regulations, including Decree No. 74965/1974, Opinion CGU/AGU dated as of August 23, 2010, issued by the General Counsel of the Federal Government Office of Brazil (which we refer to as Opinion CGU/AGU), foreign individuals and foreign legal entities are subject to restrictions on the acquisition or lease of rural properties in Brazil. Such restrictions also apply to Brazilian legal entities controlled by foreign investors or with the majority of their capital stock held by foreign investors, such as in the case of Potássio do Brasil Ltda., our operating subsidiary. As such, our future ownership and/or possession of any rural properties in Brazil may be subject to legal challenges, and our operations at the Autazes Project may be impaired due to such restrictions on the acquisition or lease of rural properties.

The legality of Opinion CGU/AGU has been, and is currently being, challenged, however, prior challenges to Opinion CGU/AGU have been unsuccessful. Under current Brazilian laws and regulations, a foreign investor may only acquire or lease rural property in Brazil, in compliance with Opinion CGU/AGU, if certain conditions are met, including, among others, that (i) foreign investors obtain approvals from the Brazilian National Institute of Rural Settlement and Agrarian Reform and from the applicable Ministries; (ii) the aggregate amount of rural property held by a foreign investor does not exceed 25% of the total surface area of the municipality in which such property is located; (iii) the acquisition of areas in excess of 100 indefinite exploitation modules will be subject to prior approval by the Brazilian Congress; (iv) the acquisition must be formalized by means of a public deed of sale and purchase; and (v) the acquisition of rural properties located at or near Brazils border areas is subject to the fulfilment of additional requirements, such as the prior authorization by the Brazilian National Defense Council. Pursuant to these laws and regulations, any agreements relating to the acquisition, lease, purchase or direct or indirect ownership or possession of rural properties by foreign individuals or entities, as well as any agreements relating to corporate changes which might imply indirect acquisition or lease of rural properties by foreign individuals or entities, may be considered null and void. Thus, our future ownership and/or possession of any rural properties in Brazil could be subject to legal challenges and/or be considered null, any of which could result in a material adverse effect on our business, results of operations, financial condition, and cash flows.

15

Table of Contents

Governmental regulations, including mining and environmental laws, regulations and other legislation, may increase our costs of doing business, restrict our operations, or result in the imposition of fines, the revocation of permits, or the shutdown of our facilities.

Our exploration and development activities are, and, once commenced, our mining operations will be, subject to governmental legislation, policies and controls relating to prospecting, development, production, environmental protection (including plant and animal species), mining taxes, and labor standards. In order for us to carry out our activities and operations, our various permits and licenses, including the Mining Concession, must be obtained and kept current. There is no guarantee that our permits and licenses, including the Mining Concession, will be granted, or that once granted, will be maintained and extended. Additionally, the terms and conditions of such licenses or permits, including the Construction Licenses, could be changed, particularly as a result of the May 2024 Civil Lawsuit, and there can be no assurances that any application to renew any existing permits or licenses will be approved. There also can be no assurance that all permits and licenses that we require will be obtainable on reasonable terms, or at all, particularly considering that the May 2024 Civil Lawsuit is still currently pending. Delays or a failure to obtain any such permits or licenses, or a failure to comply with the terms and conditions of any such permits or licenses that we have obtained, including the Construction Licenses, could have a material adverse impact on us.

Additionally, based on our current development plan for the Autazes Project and discussions with relevant governmental authorities, we will be required to contribute approximately $160 million to partially fund the cost of providing the required infrastructure to facilitate the development of the Autazes Project, primarily consisting of the cost of construction of a new power transmission line that will connect the Autazes Project to Brazils national electricity grid. Moreover, we will have to obtain and comply with our permits and licenses, including the Construction Licenses and the Mining Concession, that may contain specific conditions concerning operating procedures, water use, waste disposal, spills, environmental studies, abandonment and restoration plans, and financial assurances. There can be no assurance that we will be able to fund any such contribution costs or comply with any such conditions, and any non-funding of any such contribution costs or non-compliance with any such conditions may result in the loss of certain of our permits and licenses for the Autazes Project, which may have a material adverse effect on us.

Furthermore, future taxation of mining operators cannot be predicted with certainty so planning must be undertaken using present conditions and best estimates of any potential future changes. There is no certainty that such planning will be effective to mitigate adverse consequences of future taxation on us.

We are subject to extensive environmental laws and regulations.

Our operations are subject to extensive Brazilian federal, state, and local laws and regulations governing environmental protection. Environmental legislation is evolving in a manner that is creating stricter standards, while enforcement, fines and penalties for non-compliance are more stringent. The cost of compliance with changes in governmental regulations has the potential to reduce the profitability of our operations. Furthermore, any failure to comply fully with all applicable laws and regulations could have significant adverse effects on us, including the suspension or cessation of our operations.

Our current and future operations, including development and mining activities, are subject to extensive Brazilian federal, state and local laws and regulations governing environmental protection, including regarding the protection of endangered and other special status species and the protection and remediation of mining sites. Activities at the Autazes Property may give rise to environmental damage and create liability for us for any such damage or any violation of applicable environmental laws. To the extent we are subject to environmental liabilities, the payment of such liabilities or the costs that we may incur to remedy environmental pollution would reduce otherwise available funds and could have a material adverse effect on us. If we are unable to fully remedy an environmental problem, we may be subject to administrative, civil or criminal fines or penalties, and/or be required to suspend operations or enter into compliance measures pending completion of the required remedy. The potential exposure may be significant and could have a material adverse effect on our mining project.

16

Table of Contents