Six Reasons to Invest in Brazil Potash

Brazil's $1B Potash Play - Feeding the World

As the world races to feed a population approaching 10 billion, food security has become one of the most pressing global challenges. Fertilizers—especially potash—play a vital role in boosting crop yields and supporting sustainable agriculture. As one of the three essential nutrients for plant growth, potash strengthens plant stems, increases resistance to environmental stress, and improves the texture and flavor of many foods, making it indispensable to global food production.

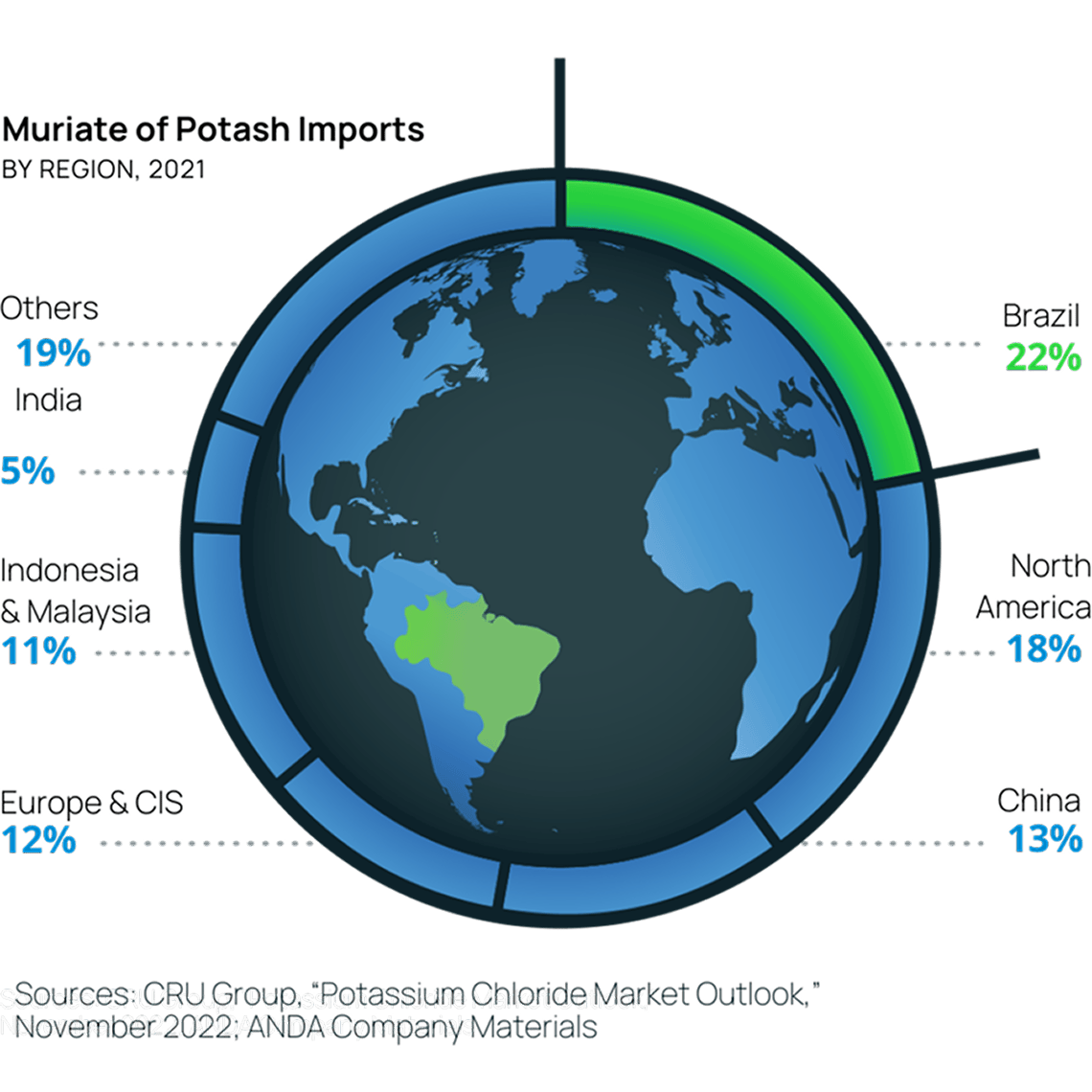

Yet, Brazil, the world’s largest agricultural exporter, relies on imports for over 95% of its potash supply, creating a vulnerable and costly bottleneck.

Brazil Potash (NYSE: GRO) is changing that.

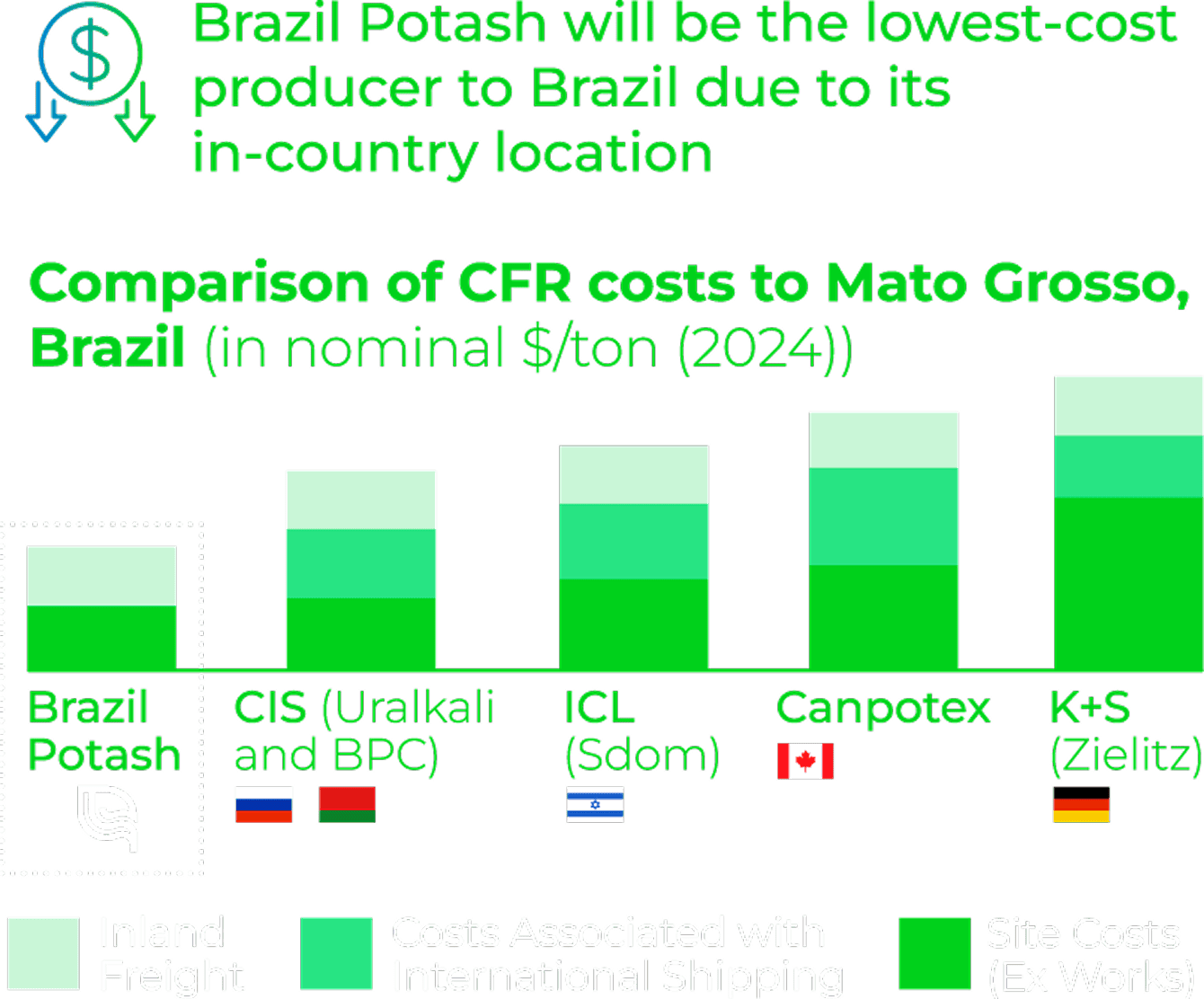

- Brazil Potash’s in country operations are predicted to allow for the extraction, processing and transport of potash to farmers in Brazil for less than the transportation cost alone for imported project all while offering a lower environmental footprint.

- Secure, local supply in an unstable world: 48% of the world’s potash exports come from countries impacted by war or sanctions. Brazil Potash offers a strategic alternative—resilient, stable, and local.

De-Risked and Construction-Ready

With the development of the Autazes Project—a world-class potash deposit located just 5 miles from the Madeira River—Brazil Potash is poised to become the country’s only major domestic producer, slashing transportation costs, reducing emissions, and enhancing food security.

Autazes Project

BRAZIL: THE ENGINE DRIVING THE POTASH MARKET

Brazil is the second-largest consumer of potash globally, yet it relies on imports for over 95% of its supply —making it the world’s top fertilizer importer. With minimal domestic production, the country depends on distant sources like Russia and Belarus, both facing ongoing geopolitical and trade instability. As the only major local producer, Brazil Potash offers a strategic advantage, operating just miles from end-users compared to current suppliers located 12,000 to 20,000 km away.

Sources: Company, CRU Group, FAO, Brazilian Secretariat of Foreign Trade, USDA. (1) According to FAO, as defined by nominal value of exports minus imports in 2022; (2) According to USDA Foreign Agricultural Service, “Brazilian Economic and Agricultural Overview”; (3) SECEX; (4) Represents comparison of delivered costs from Autazes and major incumbent exporters to Rondonopolis, Mato Grosso in nominal terms (2024); (5) Costs associated with shipping include cost to FOB, ocean freight costs, port charges, ad hoc handling expenses; (6) Inland freight to Brasnorte is reflective of either freight cost Paranagua to Brasnote (for imported product), or the inland road transportation from the Autazes Project to Brasnorte

A GOLDEN OPPORTUNITY

Strategically located in the heart of the Amazonas Basin, Brazil Potash is uniquely positioned to become the lowest-cost supplier of potash to domestic farmers. By producing potash locally—just a few miles from major inland waterways and close to key farming regions—the company avoids the costly international shipping and logistics that global competitors face. This translates to significantly lower delivered costs and reliable supply for Brazilian growers.

Brazil Potash benefits from built-in downside price protection: even in periods of global price volatility, its logistical advantage and low production costs provide a buffer that helps maintain profitability and long-term supply stability for the country’s agricultural sector.

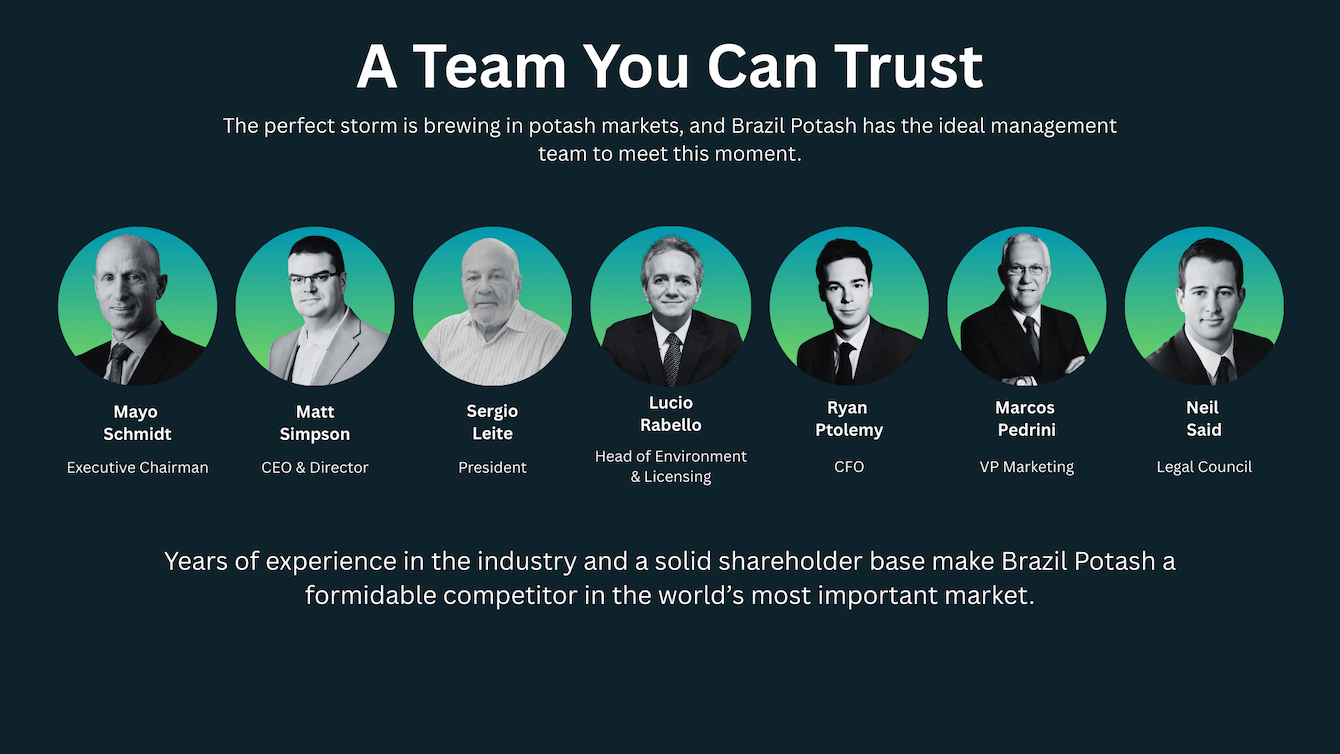

EXPERIENCED TEAM

Backed by a seasoned management team with decades of experience in resource development, project execution, and fertilizer markets, the company combines deep operational expertise.

Supported by a strong and stable shareholder base, providing the financial resilience and long-term perspective needed to advance one of the world’s most strategically vital potash projects.

Meet the TeamContact Form

We respect your privacy. We do not sell, rent, or loan any information to any third party. Any information you give us is held with the utmost care and security, and will be used only in ways to which you have consented.

Forward-Looking Statements

This document contains forward-looking statements as defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, or the United States Private Securities Litigation Reform Act of 1995. Please refer to the "Risk Factors" section in our Annual Report on Form 20-F for the year ended December 31, 2024, and other reports filed with the SEC for more information. All statements other than historical facts—including those about future business strategy, plans, goals, competitive strengths, and business growth—are forward-looking statements. These may include terms such as "anticipate," "expect," "intend," "may," "will," "should," and similar expressions. Such statements involve risks and uncertainties related to future events and circumstances, including changes in operations, estimate uncertainties, industry risks, development activities, and reliance on third parties. These statements reflect the intent, belief, and current expectations of the Company and its management, based on assumptions deemed reasonable when made. However, actual results may differ materially, and forward-looking statements are not guarantees of future performance. Even if outcomes align with expectations, they may not be indicative of future periods. Readers are cautioned not to place undue reliance on these statements, which speak only as of their date. We undertake no obligation to update or revise them to reflect future events or developments.